Aug 1, 2022

Revival of Bear Market’s Laggards Shows Perils of July Rebound

, Bloomberg News

(Bloomberg) -- Last month, an index of meme stocks rallied 12% and Cathie Wood’s flagship exchange-traded fund added 13%. Even cryptocurrencies recovered in July, with Bitcoin posting its best month since October.

In other words, the most speculative corners of the market got a lift as traders started to dial back their bets on the Federal Reserve’s policy tightening path amid slower economic growth. In July, the S&P 500 notched its best month since November 2020. But some market watchers warn that such gains can’t be sustained.

“Easing of financial conditions and the decline in yields has helped support the riskiest portions of the market,” said Dennis DeBusschere, the founder of 22V Research.

However, the most speculative assets require easier credit and financial conditions, he said. “A broad easing of financial conditions is anathema to the Fed’s goals of reducing inflation though, limiting that support. That is why we think the riskiest parts of the markets should be faded.”

As August kicks off, here’s a rundown of some of risky assets’ moves.

The Solactive Roundhill Meme Stock Index rose 12% in July, its best 30-day stretch since its inception at the end of last year. The gauge counts companies like Carvana Co., MicroStrategy Inc. and Coinbase Global Inc. as its top holdings. Meanwhile, a fund of newly public companies added 8%.

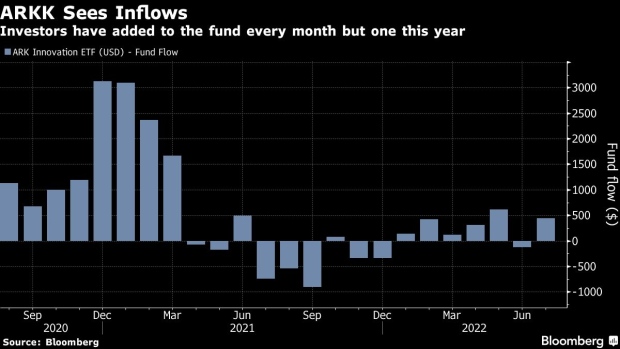

Wood’s flagship Ark Innovation ETF (ticker ARKK) had its first month of gains since October 2021, increasing by 13%. So far this year, the fund has seen inflows every month, except in June. Still, it has had a rough stretch, losing roughly half its value since 2021 started as higher interest rates dulled the appeal of its tech holdings.

Tech stocks are very volatile, Jay Willoughby, chief investment officer at TIFF Investment Management, said.

“So, when markets go up, they’re likely to go up the most,” he said. “And when markets go down, they’re likely to go down the most. That’s the way we would look at it. So ARKK is a really good example.”

The through-line for the meme index and ARKK is digital assets. Both include companies connected to crypto. ARKK invests in Coinbase, for instance.

Bitcoin, the largest digital coin by market value, gained 27% in July, the most since October of last year. Ether, the No. 2 cryptocurrency, staged an even more impressive rally, adding 70% amid optimism around an anticipated network upgrade for the Ethereum blockchain. An index of 100 of the largest tokens rose 28% last month.

Not Just Risky Assets

Separately, DeBusschere grouped S&P 1500 stocks by their credit ratings, showing that highly speculative and junk-rated firms have rallied while investment-grade companies underperformed.

To be sure, it wasn’t just speculative assets that gained over the past four weeks. Technology bellwethers Microsoft Corp., Apple Inc., Amazon.com Inc. and Alphabet Inc. -- the “trillion-dollar market cap” club -- posted strong gains days after reporting earnings last week, adding a total of $420 billion in market value, according to Bespoke Investment Group in a research note on Friday.

“For the major US indexes to get back into rally mode and stay that way, they need these mega-caps to trend higher,” the note said. The recent upside “to earnings is a bullish start.”

While inflation will likely peak and start to come down, the Fed will continue to raise rates, Stephanie Lang, chief investment officer at Homrich Berg, said in a phone interview. Therefore, “we’re a little bit cautious on this rally,” she said.

©2022 Bloomberg L.P.