Feb 7, 2023

Quant Funds Shed Billions as Wall Street’s Hottest Trends Falter

, Bloomberg News

(Bloomberg) -- The triumphant comeback of quant-investing strategies on Wall Street is suddenly on shaky ground as virtually all of 2022’s hottest market trends get derailed in the new year.

Investors have been rushing to price an end to monetary tightening and a potential soft landing for the US economy, defying hawkish messages from the Federal Reserve. All that has revived megacap tech stocks and curbed broad-based gains in equity benchmarks.

That’s exactly the type of environment that works against many systematic strategies, which tend to benefit from wider dispersion in stock performance or which surf enduring price trends. The cohort had been enjoying a banner two years as inflation and surging borrowing costs fueled strong cross-market currents and finally ended the dominance of giant tech shares.

Now, a typical portfolio that slices and dices the equity landscape by factors like how cheap companies trade has lost money for four straight weeks, according to a Bloomberg-GSAM index, the worst streak since 2019. A gauge of alternative risk premia — factors across asset classes — is on the worst run since 2020.

Thank a fickle market that’s been rising or retreating on every word of central bankers — like Tuesday, when dovish comments from Fed Chair Jerome Powell triggered a rally that quickly flipped when he turned more hawkish.

Meanwhile, Commodity Trading Advisors, which surf price trends by trading futures, have gone nowhere in the past few months, even as they finished their best annual performance since at least 2000.

Early evidence suggests shifting risk appetite is taking a toll on appetite for quant strategies. Smart-beta equity ETFs — which typically offer long-only versions of factors — posted outflows of about $4.8 billion in January. The sector is just one part of the quant world, but that was the largest monthly exit in at least four years. Meanwhile, a CTA-mimicking fund that was one of the most in-demand ETFs of 2022 is seeing mounting outflows.

“There have been a lot of tourists,” said Nicolas Rabener, founder of financial research firm Finominal. “Not all those folks who have allocated believe or understand the role of those strategies.”

These performance-chasing investors are likely calculating that if the Federal Reserve can tame inflation without triggering a US recession, it flips the outlook for rules-based strategies that have ridden the powerful trends of the past two years.

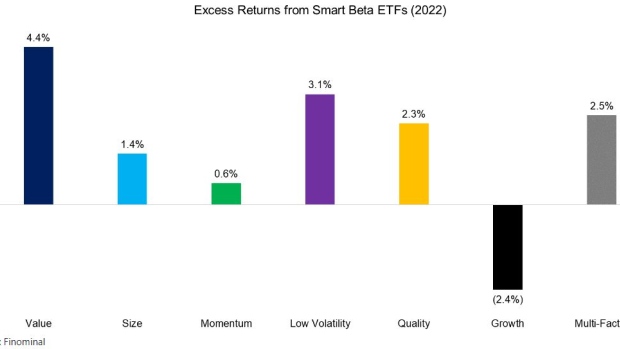

While a few smart-beta styles — like growth — could actually benefit in the new regime, most thrived when the giant tech stocks weren’t dominating market performance. Factor investing enjoyed the best year in a decade in 2022, according to Finominal, as approaches including value, quality, low volatility and momentum all advanced while broad equity indexes fell.

The potential revival of megacap tech stocks is bad news because many of these factors are effectively betting against those names as part of their long-short portfolios. Even in smart-beta ETFs, which don’t have a short component, funds suffer because they’re under-exposed on the long side.

At Seven Investment Management LLP, the team in recent months has been cutting their overweights on value and small-caps.

“Everything feels more balanced than it did a year or so ago — valuations in bonds, equity markets in general and especially the parts of the market like tech that were more pronounced as outliers,” said Matthew Yeates, deputy chief investment officer at Seven, which oversees about £19 billion ($23 billion).

There’s no guarantee the widespread reversal of last year’s market trends will endure. Broad stock gauges slumped late last week when US employment data came in hotter-than-expected, giving the Fed a green light to keep policy tight.

Higher yields, a weaker economy or a combination of the two could quickly see the trends of 2022 return to the market.

Those helped power a 27% surge for a Societe Generale SA index of trend-following CTAs last year. Touting an easy-access version of a CTA strategy, the iM DBi Managed Futures Strategy ETF (ticker DBMF), exploded from $60 million in assets at the start of 2022 to around $1 billion in October.

But CTAs largely stumbled in November with the index falling 6%. DBMF lost 8.8%, and the fund posted outflows in December and January.

“Most of the investors have always viewed DBMF as a long-term allocation, but whenever you have something that is up as much as this ETF was you also get a lot of hot money,” said Andrew Beer, founder of Dynamic Beta Investments and co-manager of DBMF. “The reality is people chase performance. If you want to have successful allocation to managed futures as a strategy you shouldn’t be thinking about what happened over the last three months but what is going to happen over the next years.”

©2023 Bloomberg L.P.