Feb 7, 2023

Putin’s Government Leans on Central Bank to Signal Looser Policy

, Bloomberg News

(Bloomberg) -- President Vladimir Putin’s government is pressuring the Bank of Russia to be more upbeat about the outlook for the economy and signal it’s ready to loosen monetary policy as his invasion of Ukraine heads for its second year.

Coming ahead of the central bank’s first board meeting of the year on Friday, officials want it to send a clearer hint that interest rates may come down later this year, according to people familiar with internal deliberations.

Governor Elvira Nabiullina and her colleagues so far are unwilling to suggest any imminent easing because of risks of higher inflation, they said, and instead are likely to indicate that rates have little room to fall.

But they are open to improving forecasts, with the government content if the central bank delivers a message that puts it on a track toward looser policy in the months ahead, the people said, speaking on condition of anonymity to describe the unusual conflict within the economic team.

At stake in the dispute is the direction of policy at a time when plunging oil revenue and increases in defense spending strain the budget. The economy is heading for its first consecutive years of contraction this century.

Under its most recent outlook last October, the central bank anticipated its benchmark will average 6.5%-8.5% this year, meaning both hikes and cuts are possible. Economists unanimously predict that on Friday the key rate will stay at 7.5% for the third time in a row.

Official borrowing costs haven’t changed since the central bank paused its steep monetary easing cycle that more than reversed an emergency hike after the invasion.

The central bank didn’t respond because of a communication blackout before rate meetings. The government’s press service didn’t immediately respond to a request for comment.

In a later comment to Russian media including the Kommersant newspaper, Prime Minister Mikhail Mishustin’s spokesman denied that that government is putting any pressure on the central bank and said the cabinet is in constant contact with the monetary authority, “acting within their powers and functions” to support the economy in the face of sanctions.

What Bloomberg Economics Says...

“If federal spending moves higher in line with guidance and the government continues its FX sales, the central bank could resume cutting the policy rate in the first half of this year.”

—Alexander Isakov, Russia economist. For more, click here

With Nabiullina in charge since 2013, the central bank still operates with a high degree of independence. The governor is a key architect of wartime policies that held the Russian economy together in the face of sanctions from the US and its allies.

Though she sought to resign after Putin ordered the attack on Ukraine, Bloomberg News has reported, the president nominated her for a new five-year term just weeks after the war began in February 2022.

Senior officials have, however, been critical of the central bank for mismanaging market expectations and what they see as overly pessimistic forecasts that have routinely proved too alarmist, according to the people.

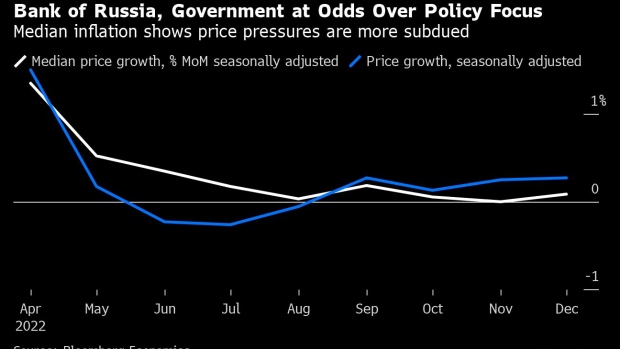

As evidence for a lack of cost pressures, the government points to alternative measures like median inflation, which filters out extreme price movements and has been around zero since May after an upswing that followed the first rounds of sanctions.

The Bank of Russia, which last cut rates in September before adopting a “neutral” bias, has countered that slower inflation may be temporary and the economic situation is too unstable to allow for more precise projections, the people said.

Policymakers last projected that inflation will hit their 4% target next year — from 5% to 7% in 2023. Bloomberg Economics expects that a steadier ruble and slower credit growth will bring consumer inflation below 6% in 2023, from just under 12% in December.

The central bank has recently focused on risks to inflation stemming from budget spending, growth in nominal wages and labor shortages as a result of the Kremlin’s call-up of men to fight in Ukraine.

Last week, central bank First Deputy Governor Ksenia Yudaeva already flagged the likelihood that forecasts may be revised as a result of changes in the labor market, oil prices and other factors. In an interview with Tinkoff Private Talks, she also stuck to a more hawkish line and argued that consumer demand is subdued not because of high rates but as a result of uncertainty and supply disruptions.

(Updates with government comment in ninth paragraph.)

©2023 Bloomberg L.P.