Mar 29, 2024

Powell Says Latest Inflation Data ‘In Line With Expectations’

, Bloomberg News

(Bloomberg) -- Federal Reserve Chair Jerome Powell repeated that the US central bank isn’t in any rush to cut interest rates as policymakers await more evidence that inflation is contained.

“The fact that the US economy is growing at such a solid pace, the fact that the labor market is still very, very strong, gives us the chance to just be a little more confident about inflation coming down before we take the important step of cutting rates,” Powell said Friday at an event at the San Francisco Fed.

Fresh inflation data released earlier is “pretty much in line with our expectations,” he said. But Powell reiterated it won’t be appropriate to lower rates until officials are sure inflation is on track toward 2%, the rate they see as appropriate for a healthy economy.

Investors are now betting the US central bank will make that first cut in June.

“The overall message really hasn’t changed too much,” said Veronica Clark, an economist at Citigroup Inc. “It seems like February inflation data came in line with how they were expecting, and that’s in line with more prints that they would be OK with.”

“We’re in the mode now of just gaining a bit more confidence, a couple more months of data, and they’re still going to be willing to cut mid-year,” she added.

The Fed’s preferred gauge of underlying inflation cooled last month after an even larger increase than previously reported in January, government data released Friday showed.

The core personal consumption expenditures price index — which excludes volatile food and energy costs — rose 0.3% in February after climbing 0.5% in the previous month, marking its biggest back-to-back gain in a year. The measure is up 2.8% from a year earlier, still above the Fed’s 2% target.

Read More: Fed’s Preferred Inflation Metric Cools While Spending Rebounds

“It’s good to see something coming in in line with expectations,” Powell said of the data, adding that the latest readings aren’t as good as what policymakers saw last year.

Powell said officials expect inflation to continue falling on a “sometimes bumpy path,” echoing remarks he made following the Fed’s last policy meeting earlier this month.

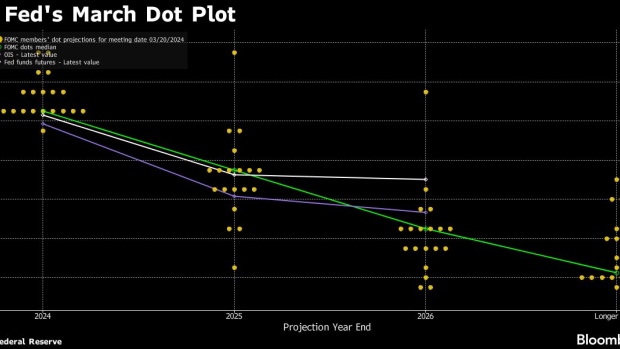

Fed officials held short-term interest rates at a more than two-decade high at that meeting, and a narrow majority penciled in three rate cuts for 2024.

Powell has said it would likely be appropriate for the Fed to ease policy “at some point this year.” But he and other policymakers have made clear they’re approaching the first cut with caution, given the underlying strength of the economy and recent signs of persistent price pressures.

The Fed chief said Friday he doesn’t see the possibility of a recession as elevated at this time. Still, he reiterated that an unexpected weakening in the labor market could warrant a policy response from Fed officials.

Inflation Cooling

Inflation has eased substantially from a 40-year peak reached in 2022, decelerating at a particularly fast clip last year. That progress appeared to stall in January and February, with a pickup in consumer price growth.

Meanwhile, the US economy has remained resilient despite high interest rates. Inflation-adjusted consumer spending topped all economists’ estimates in February, and employers are still hiring workers at a robust clip. Data out earlier this week showed economic growth in the fourth quarter was stronger than originally thought.

Although Fed officials’ median projection for three rate cuts this year was unchanged from December, nearly half forecast two or fewer rate reductions in 2024. Most policymakers have said they want to see further evidence that inflation is coming down toward their 2% goal before making their first move.

Governor Christopher Waller, an early proponent of raising rates high and fast to contain price pressures, said Wednesday that disappointing inflation data from the start of the year means policymakers may need to keep rates elevated for longer than previously thought or even reduce the overall number of rate cuts.

Read More: Waller Says Fed Should Delay or Reduce Cuts After New Data

But Powell and his colleagues have said they don’t need to see inflation hit their target before they start lowering borrowing costs. As inflation declines, elevated rates are putting more pressure on the economy, and some policymakers reason it may be appropriate to lower them soon to avoid unduly harming the labor market.

“You have a Fed that at the moment is highly data dependent, and needs to see better inflation prints over the next several months,” said Matthew Luzzetti, chief US economist at Deutsche Bank.

“There’s broad-based expectations that those better inflation prints will come about, but really until that data are released and we get either confirmation or a different view on what the data are going to be, it’s kind of hard to gauge exactly where we end up from a Fed policy perspective.”

(Updates with additional Powell comments, economists’ reaction.)

©2024 Bloomberg L.P.