Mar 4, 2024

Pakistan’s Prime Minister Orders Starting Talks with IMF for Loan

, Bloomberg News

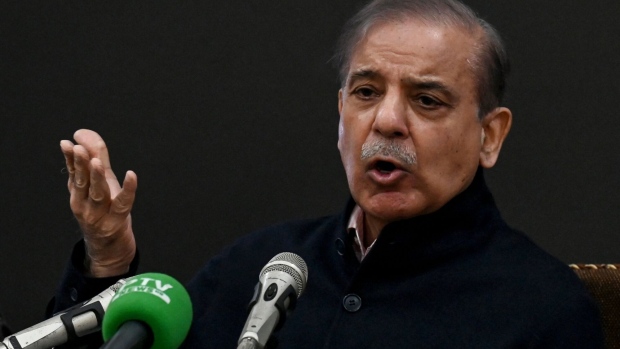

(Bloomberg) -- Pakistan Prime Minister Shehbaz Sharif directed authorities to fasttrack negotiations with the International Monetary Fund, as the nation’s $3 billion bailout program is set to end in April.

Sharif gave the order to expedite talks for a new loan after he was briefed by Finance Secretary Imdad Ullah Bosal in a meeting with senior government leaders, according to a statement issued by the prime minister’s office. He was sworn in as the country’s leader earlier on Monday.

Pakistan had planned to seek a new loan of at least $6 billion from the IMF, Bloomberg News had reported. There is also a $1.1 billion final tranche that has yet to be released under the current program.

After narrowly avoiding a sovereign default last year, Pakistan will need to secure fresh funds as soon as possible, Sharif said last month. The South Asian nation faces $25 billion of external debt payments in the fiscal year starting July, about three times its foreign-exchange reserves.

Sharif has yet to appoint a new finance minister to lead the talks with the multilateral lender. Habib Bank Ltd. President Muhammad Aurangzeb, who is seen as a possible candidate, attended the meeting on Monday. Current Interim Finance Minister Shamshad Akhtar and Sharif ally Ishaq Dar were not present, the prime minister’s office later said in response to Bloomberg queries.

Still, Sharif’s return as prime minister increases Pakistan’s chances of securing a new IMF aid package, Bloomberg Economics said, citing his previous administration’s track record of carrying out reforms. His party’s election manifesto — which includes cutting the fiscal deficit and fixing the current account balance — are aligned with the IMF targets or, in some cases, even more ambitious, Ankur Shukla, a Bloomberg Economics analyst in Mumbai, wrote in the report.

Aisha Ghaus Pasha, a former junior finance minister and an economist, said Pakistan needs IMF loans to gain two to three years of fiscal space in order to implement reforms.

“The IMF program would be tough as Pakistan has to take some difficult reforms,” she said. “When we sit across table from the IMF, we need to demonstrate to them that this is a government which means business.”

IMF aid will help in retaining support from creditor nations such as Saudi Arabia and the United Arab Emirates, which poured billions of dollars in financing. Securing a new deal may also boost Pakistan’s dollar bonds, which have handed investors a gain of almost 17% this year.

--With assistance from Faseeh Mangi and Jim Silver.

(Updates throughout)

©2024 Bloomberg L.P.