Mar 22, 2024

Options Show Bitcoin Traders Are Preparing for a Deeper Slump

, Bloomberg News

(Bloomberg) -- Options suggest that traders are bracing for an extended decline in Bitcoin with demand for US exchange-traded funds holding the cryptocurrency beginning to wane.

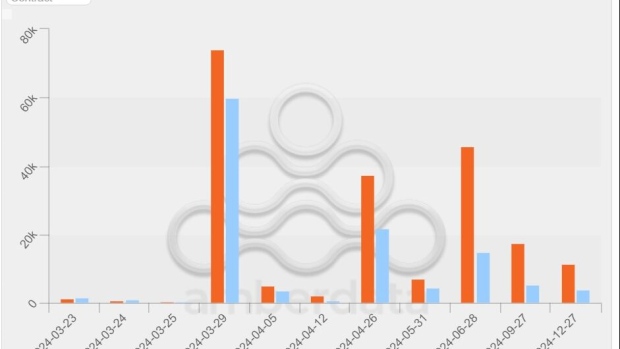

Bitcoin put options expiring on March 29 exceeded call options in volume in the past 24 hours. That has nudged the put-to-call ratio, which is a key indicator of market sentiment for the underlying asset, higher, signaling a bearish outlook in the near term, according to data from crypto options exchange Deribit. The strike prices of puts are clustered around $50,000 and $45,000 on the platform. Bitcoin traded at around $63,500 on Friday.

“Today’s market correction is mostly coming on the back of GBTC outflows remaining heavy,” said David Lawant, head of research at crypto prime broker FalconX, referring to the Grayscale Bitcoin Trust. “Spot ETF net inflows data as of yesterday showed the second fourth-day streak of outflows since these products launched on January 11.”

Bitcoin has dropped over 10% from its all-time high, one of the largest retreats this year, as the group of 10 spot Bitcoin ETFs is on its way to post the biggest outflow since the launch. Over $177 million in bullish bets were liquidated in the past 24 hours, according to data from Coinglass.

The pullback in Bitcoin is in contrast to this week’s rally in the stock market, where traders are more optimistic that the Federal Reserve will cut interest rates this year.

“On the day surrounding FOMC, we saw digital assets also reacting to the positive macro tailwinds,” said Chris Newhouse, DeFi analyst at Cumberland Labs. “However, a weakening in correlation to equities, driven by product-specific outflows and liquidations, seems to have driven BTC and ETH lower.”

The funding rates, for perpetual futures, which indicates the level of leverage in crypto trading, remains relatively low after bouts of liquidations in recent months, suggesting the current drop in Bitcoin may not be as sharp as the previous pullbacks. The high level of leverage in long positions accelerated the slump in Bitcoin on Monday with over $582 million in long liquidations on Monday. The total liquidation was over $738 million.

©2024 Bloomberg L.P.