Jun 8, 2023

Not Even Surprises by Central Banks Can Send Volatility Higher

, Bloomberg News

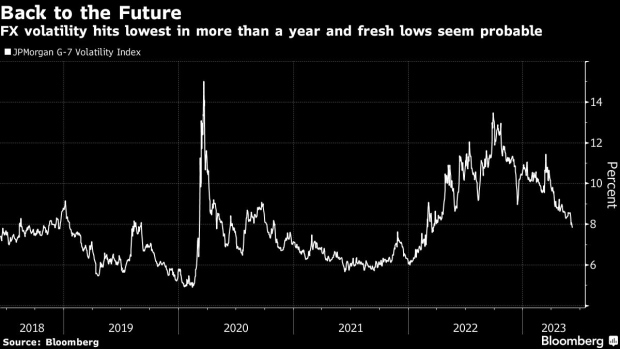

(Bloomberg) -- Not even central banks springing surprises on the market in the shape of unexpected rate hikes seem able for now to spur greater volatility in the currency market.

The Reserve Bank of Australia and the Bank of Canada caught most analysts off guard this week by raising their interest rates by a quarter point, respectively citing upside risks to inflation and excess demand in the economy.

Yet this failed to spur demand for protection from price swings in the Australian and Canadian dollars over the short- to medium-term. Meanwhile, the low-volatility trend that has dominated this year refuses to budge even as traders weigh the chances of potential upsets tied to next week’s meetings by the Federal Reserve and the European Central Bank.

The cost of hedging swings in the majors rose in September to levels not see in a decade, if we exclude a brief rally during the pandemic-driven market mayhem in March 2020. Geopolitical risks played their part, yet the key driver was monetary policy-tightening by the world’s major central banks.

Volatility has kept falling since then as investors concluded inflation and terminal rates are on their way toward a peak. Yet while price pressures have eased globally, they remain far off the targets set by central bank policymakers who are now expected to increase borrowing costs further.

But for now, options traders are sticking to their guns. One-week volatility in the euro, which captures the upcoming Fed and ECB decisions for the first time, rose to an one-month high earlier. Yet it still remains below its year-to-date average with money markets fully pricing in a 25 basis-point hike by the ECB and assigning a one-in-three chance for a similar move by the US central bank.

The risk that officials turn more hawkish than expected, perhaps by raising rates by more than foreseen or being more forthright about inflation risks in their forward guidance, isn’t seen as enough by itself to alter the market’s volatility outlook. Whether it be down to traders seeing central bank policy starting to converge or the approaching summer lull, investors can hedge FX movements at a relatively low cost.

And that’s not true only for the short-term. Traders’ expectations for calmer seas ahead are even more evident at the back end of the curves. One-year options in euro-dollar are now at their most underpriced since 2009 as implied volatility trades below 7%, its lowest in 15 months.

- NOTE: Vassilis Karamanis is an FX and rates strategist who writes for Bloomberg. The observations he makes are his own and are not intended as investment advice

©2023 Bloomberg L.P.