Dec 11, 2023

Larry Berman on where the U.S. Fed is headed on interest rates

By Larry Berman

Larry Berman's Market Outlook

At the last U.S. Federal Open Market Committee (FOMC) meeting, U.S. central bankers hit the rate hike pause button and followed it up with rhetoric that led to a significant easing of financial conditions.

Prior to last meeting, many FOMC members remarked that the term premium for long bonds had turned positive and was doing some of the tightening work for them. We doubt they were looking to push financial conditions to the easiest levels of the year.

What seems clear now is that higher rates have not had much breaking power on the U.S. economy following the recent employment report. While the lower-income consumer is under some duress and loan loss provisions are rising while auto loan delinquencies are up, the aggregate economy is still performing relatively well and we are pretty much at full employment. This suggests the notion of easing is premature.

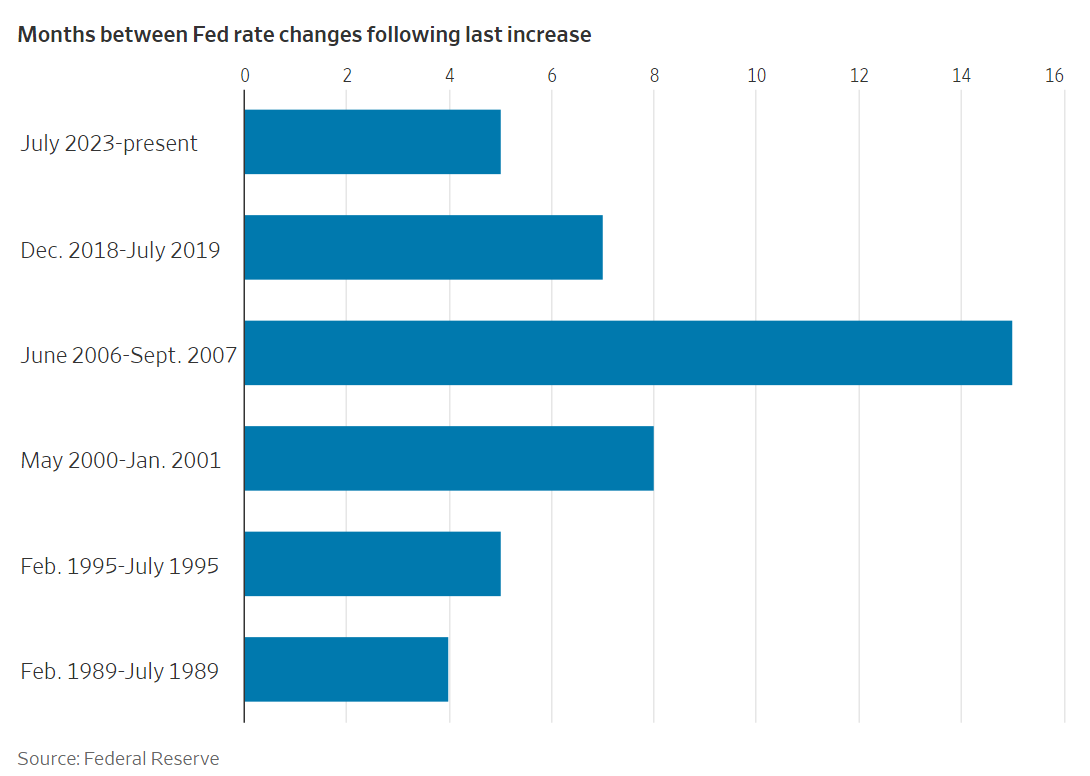

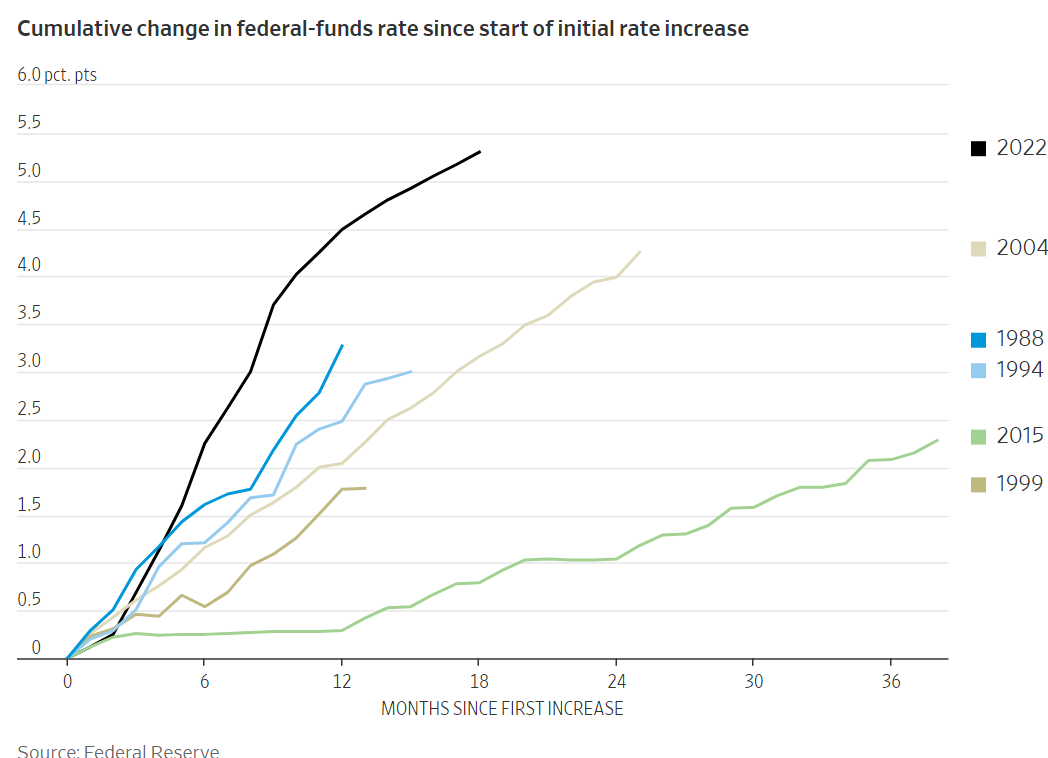

A recent Nick Timiraos story in the Wall Street Journal (a well-known FOMC leak portal) highlighted parts of the Fed’s dilemma. The history of rate cuts has shown that the first rate cut is likely due in Q1, based on the average of the past several tightening cycles. The difference is that in recent decades, fighting inflation was not a major consideration like it is today. That makes this cycle quite a bit different.

This is also the fastest and most acute rate hike cycle in history, which makes it quite a bit different from past cycles. To suggest that the U.S. Fed will create the perfect soft landing outcome appears to me to be very naive, yet that is far and away the broad consensus on the Street. We think something different will happen.

The WSJ article highlighted two rate-cutting scenarios.

“First, the Fed would cut simply because the economy is slowing and unemployment is rising faster than expected. If the unemployment rate starts to rise in a way consistent with past recessions, we’re back to our normal playbook,” Chicago Fed President Austan Goolsbee said in an interview last month. Last week’s employment report likely killed this scenario.

A second, more tantalizing prospect for investors is that the Fed will cut even though the economy is doing fine because monthly inflation readings have returned closer to the low levels seen before the pandemic. Holding rates steady as inflation falls would lead inflation-adjusted, or “real,” rates to rise, which the Fed doesn’t want. So officials could cut nominal rates to maintain real rates at a steady level.

Fed Governor Christopher Waller recently fuelled optimism about that possibility, when he said the central bank could theoretically begin reducing rates by the spring if inflation behaves especially well.

“If we see this (lower) inflation continuing for several more months – I don’t know how long that might be, three months, four months, five months? – we might feel confident that inflation is really down,” said Waller. His comment drew special attention from investors because he has been a leading advocate for tighter policy since 2021.

At September’s meeting, the median expectation was for one more possible rate hike and two rate cuts were considered likely for 2024. This was considered very hawkish.

A look at the U.S. Fed’s dot plots and market-based pricing currently shows the market is pricing 4.5 rate cuts by the end of 2024. Look for the median dot plot to move a bit (2.5 cuts) from the September estimates, but not anywhere close to where the market is priced.

If the FOMC somehow validates that exuberance, financial conditions will get much looser, making the Fed’s job of a soft landing much harder. Powell will certainly reiterate their goal of a perfect landing, but logic dictates that is extremely unlikely. Markets can remain illogical longer than one can remain solvent. It will be interesting to see if any of the “stickier” hawk plots in 2025 and beyond make any progress coming down. This will also hint at their willingness to move sooner. There is massive disagreement on how long “higher-for-longer” will be.

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

Facebook: @LarryBermanETF

LinkedIn: LarryBerman

www.etfcm.com