Apr 19, 2024

L’Oreal Gains Cap Third Week of Declines for European Stocks

, Bloomberg News

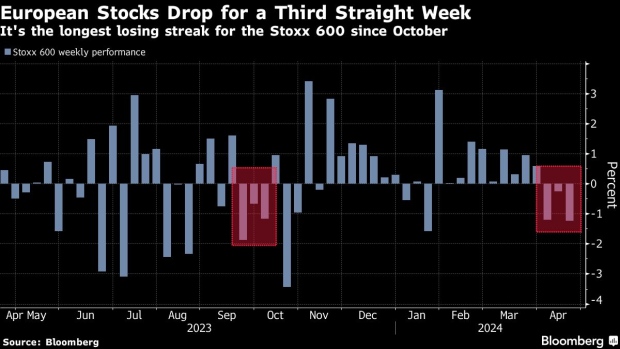

(Bloomberg) -- European stocks declined for a third straight week due to geopolitical tensions and worries about higher-for-longer interest rates. L’Oreal SA rallied after better-than-expected quarterly sales.

The Stoxx Europe 600 Index was little changed by the close, after earlier dropping as much as 0.9%. The index still fell more than 1% on the week.

Technology stocks slumped Friday, tracking a drop in US tech stocks after a disappointing earnings report from Netflix Inc. European food and beverage and telecom stocks outperformed. L’Oreal jumped after the cosmetics maker’s like-for-like sales beat expectations, quelling worries over a slowdown in the beauty market.

Risk demand was dampened earlier after Israel launched a retaliatory strike on Iran less than a week after Tehran’s rocket and drone barrage, according to two US officials, but Iranian media appeared to downplay the incident in the hours that followed the initial reports.

“The markets, as they have done in recent months, are reacting very calmly and objectively regarding the real risk that an escalation in the Middle East could significantly affect the world economy,” said Roberto Scholtes, head of strategy at Singular Bank. “Oil has not rebounded in recent days, and its rise in previous months is largely due to the strength of demand.”

A rally in European stocks has faltered this month as investors also worry that the Federal Reserve could hold interest rates higher for longer. Focus is also shifting to the first-quarter corporate earnings season.

Among other individual movers Friday, Royal Unibrew A/S shares soared after the brewer reported preliminary net revenue and Ebit that came ahead of consensus expectations.

For more on equity markets:

- Strategists Are Not All Pessimistic About Europe: Talking Stock

- M&A Watch Europe: Believe, Schneider, Volvo, Telecom Italia, PGE

- Paris Joins IPO Revival With Tech Firm’s Solid Debut: ECM Watch

- US Stock Futures Slide as Mideast Tensions Deepen Risk-Off Mood

- For a Song: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Sagarika Jaisinghani, Michael Msika, Tugce Ozsoy, Sonja Wind and Ellie Harmsworth.

©2024 Bloomberg L.P.