Apr 25, 2024

IPO Rebound Creates $5.8 Billion in Wealth From Nursing to Tech

, Bloomberg News

(Bloomberg) -- A re-awakened market for initial public offerings is creating new fortunes across the US.

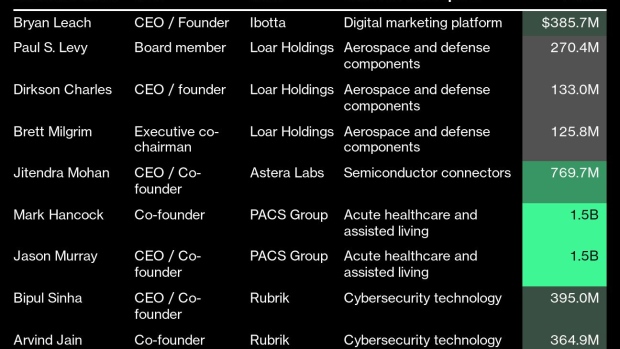

Founders are taking advantage of strong equity markets to raise cash, accruing at least $5.8 billion in wealth so far this year, according to the Bloomberg Billionaires Index.

It’s a marked change in tone after high interest rates and recession fears derailed many planned IPOs in 2023. Two blockbuster deals, Reddit Inc. and Galderma Group AG, raised roughly $3 billion between them last month, giving the green light to other companies offering everything from assisted living to semiconductor connectors to airplane components.

More than $13.7 billion has now been raised in US debuts so far in 2024, over three times the amount achieved in the same period last year.

“Whenever we see broad sectors access the capital markets it’s a positive sign for everyone that’s looking to go,” said Mike Bellin, IPO services leader at PwC.

AI Hype

Rubrik Inc. is set to list Thursday after raising $752 million at a fully diluted valuation of more than $6.6 billion. The cybersecurity firm embraced the current hype around artificial intelligence, with its IPO prospectus marketing AI as both increasing the threat of cyberattacks and increasing the amount of data clients will need to secure.

Its founding trio, all graduates of the Indian Institute of Technology who pursued further education and technology careers in the US, will own stakes in the company worth a combined $1.1 billion, according to the Bloomberg Billionaires Index.

One of them, Bipul Sinha, the company’s 50-year-old chief executive officer, could add to those riches. Rubrik’s compensation plan will award the Oracle Corp. veteran as many as 8 million additional shares in 10 tranches if the company’s stock hits certain targets ranging from 134% to 759% of its IPO price.

At the top end of that range, the additional shares alone would be worth nearly $2.2 billion.

Not every company going public is banking on AI hype, but they can still be lucrative.

Take PACS Group Inc. Based a world away from Silicon Valley in the Salt Lake City suburb of Farmington, Utah, PACS is a provider of post-acute health care and assisted-living services.

The company’s two founders, Jason Murray and Mark Hancock, both worked as nursing-home administrators before founding PACS in 2013. Since then, they’ve grown the business from two facilities to more than 200. They were the sole owners before taking their company public earlier this month.

After raising $450 million at a valuation of more than $3.1 billion, their stakes are now worth roughly $1.5 billion each, according to Bloomberg’s wealth index.

--With assistance from Bailey Lipschultz.

©2024 Bloomberg L.P.