Apr 23, 2024

Investors Loved Weak Yen Boosting Shares Until It Went Too Far

, Bloomberg News

(Bloomberg) -- The yen has become stuck around a 34-year low against the dollar after months of declines, increasing concern the currency is becoming a liability for Japan’s economy and stocks.

Japan’s depreciating currency has helped the country’s shares climb to records, as many of the biggest companies are manufacturers whose income earned abroad rises in yen terms. In the broad Topix Index, transport equipment firms including automakers and electrical machinery companies represent more than 25% of the weighting.

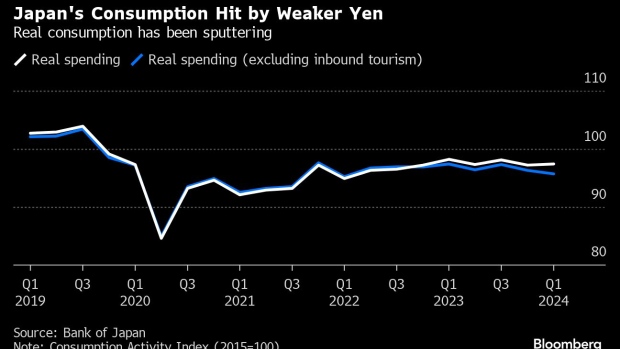

But the yen’s slide has pushed up import bills in Japan, keeping domestic consumer spending tepid since the currency began weakening in 2022. That’s weighed on companies that rely on the home market for profits. Firms including retailers and railway operators underperformed the broader market despite a record number of tourists visiting from abroad. Earnings announcements by most Japanese companies in coming weeks will likely highlight the rising divergence between strong and weak companies.

Business leaders in Japan have joined policymakers in expressing alarm about the yen’s plunge, with the head of the nation’s biggest business lobby group known as Keidanren saying Tuesday that the weakening has been excessive. Government officials have warned they’re ready to take action in the currency market, but with the yield gap between Japan and the US remaining wide, the effects of intervention may be fleeting.

“While there’s room for corporate earnings to rise on further yen weakness, there could be bigger damage to consumers,” said Kensuke Niihara, chief investment officer for Japan at State Street Global Advisors.

Investors that were bullish on Japan bet that the biggest wage hikes in more than 30 years will spur a recovery in spending this year. The prevailing assumption behind the view was that the Federal Reserve will start cutting interest rates in coming months, helping the yen rebound. But those expectations are fading due to strong US economic data.

JPMorgan analysts including Rie Nishihara say any gains in real wages may evaporate if the yen depreciates beyond 157 per dollar. The currency traded around 154.80 per dollar early Wednesday in Tokyo.

Since the yen extended losses beyond its historic low during the last week of March, the Nikkei 225 Stock Average has tumbled more than 8% from a record. The yen’s slide had been one of the bullish factors that helped Japanese stocks outperform amid an inflow of foreign funds.

Pressure is growing on the government to support the yen. Small and mid-sized companies are suffering from the rising costs of imported materials, the head of the Tokyo Chamber of Commerce and Industry said last week at a press conference, Kyodo News reported. A day earlier, the president of Suntory Holdings Ltd. told reporters the situation “needs to be corrected.”

Import price inflation won’t rise radically from the current levels around 1.4%, said Nobuyasu Atago, chief economist at Rakuten Securities Inc.

Still, “it is possible that moves in exchange rates could prompt a BOJ policy change or promote a political atmosphere that would lead to such a change,” said State Street’s Niihara.

Domestic consumption-related stocks have been sluggish. The Topix Land Transport Index, made up of railway operators and the transportation industry, has been flat since the start of the year, underperforming a 12.5% gain in the broader Topix.

A key measure of consumption activity underscores why those companies have struggled, declining for two straight quarters. Excluding spending by foreign tourists, real consumption in January-March fell to the lowest in two years.

Shares of retailers are trailing the broader market with a gain of only 8% so far this year. While tourism has helped department stores, about 40% of the members in the Topix subindex for retailers were in the red so far this year.

“For retailers, a boost from price hikes will have run its course soon,” said Nobuhiko Kuramochi, market strategist at Mizuho Securities Co. “We have to see whether consumers will turn thrifty again.”

©2024 Bloomberg L.P.