Jul 13, 2021

Investors brace for another Bank of Canada bond taper

, Bloomberg News

BoC and Fed will react if there is ongoing inflation in 2023: Former BoC governor David Dodge

The Bank of Canada is expected to continue scaling back emergency levels of stimulus on Wednesday amid growing optimism about the speed of the recovery.

The Ottawa-based central bank is unanimously forecast to cut its weekly purchases of Canadian government bonds by one-third to C$2 billion ($1.6 billion) per week when it announces its policy decision at 10 a.m. Wednesday, according to a survey of 17 economists.

The central bank is certain to hold its key overnight interest rate at 0.25%, but traders increasingly expect it will begin raising rates in the next year. Swaps trading suggests investors are fully pricing in a hike over the next 12 months, and a total of four over the next two years, which would leave Canada with one of the highest policy rates among advanced economies.

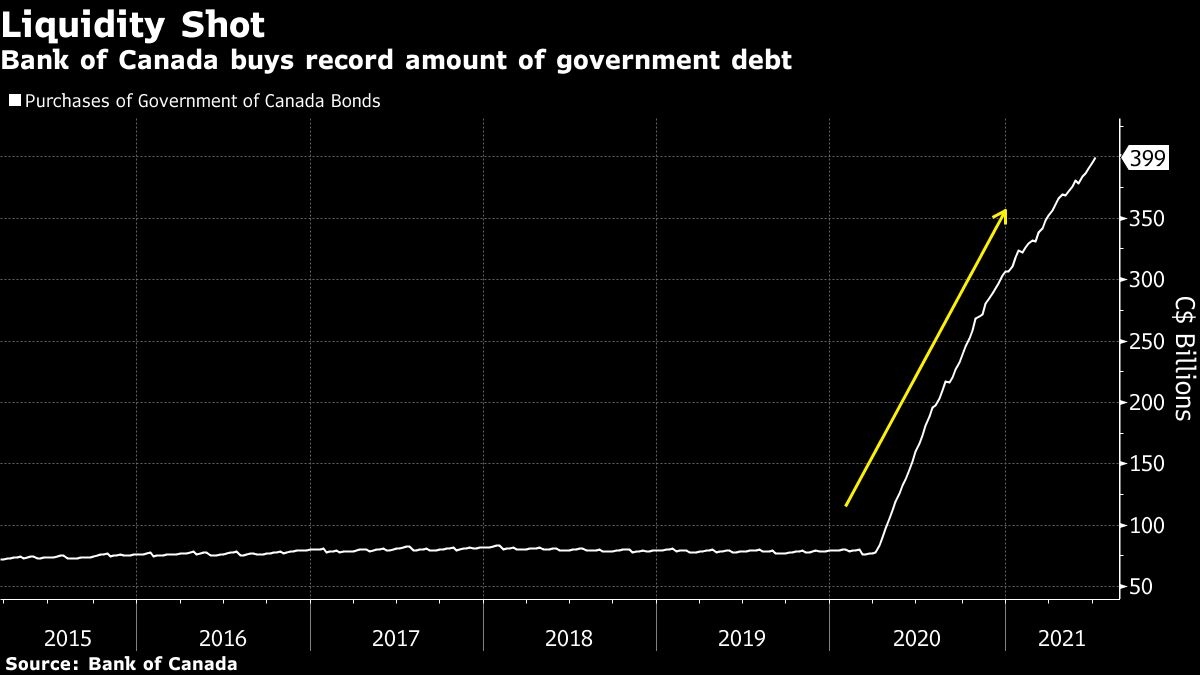

A taper would mark the third time officials have downsized the asset purchase program since the end of last year as the Canadian economy approaches a full recovery from the Covid-19 pandemic, putting Governor Tiff Macklem on the vanguard of unwinding stimulus among his peers. The central bank has said it wants to stop adding to its holdings of government bonds before it turns its attention to debating rate increases.

The Bank of Canada is “encouraged by how the recovery is proceeding,” Veronica Clark, an economist at Citigroup Global Markets Inc., said by phone.

The Canadian central bank already reduced weekly purchases of government debt by 40% to C$3 billion, first in October then again in April, and pledged to continue paring back as long as the economy remains on track to remove all slack by next year. New forecasts also due Wednesday are expected to show exactly that, and Macklem will hold a news conference at 11 a.m. to shed more light on his plans.

Business and consumer confidence -- along with commodity prices -- are at or near records. Households are flush with cash and there is plenty of fiscal stimulus in the pipeline, including spillover benefits from U.S. spending. The vaccine rollout is accelerating and a jobs surge in June is signaling the economy has brushed off the effects of the most recent wave of lockdowns.

Economists predict Canadian output and employment will recover to pre-pandemic levels as early as the third quarter -- even though slack will linger. There’s an outside chance the central bank may even bring forward timing of a full rebound to the first half of 2022 rather than the end of it.

“It’s fair to say the recovery is evolving in line with the bank’s expectations,” Josh Nye, an economist at Royal Bank of Canada, said by email.

What Bloomberg Economics Says...

Bloomberg Economics’ view is policy makers will strive for a fuller jobs recovery than in the past, the main reason we see a slightly later-than-consensus hike, in early 2023.

--Andrew Husby, economist.

Analysts anticipate the outlook will allow Macklem to reduce purchases to about C$1 billion per week by later this year, which would bring the central bank near a neutral pace where holdings remain unchanged as securities mature.

The Bank of Canada has bought a net C$320 billion in Canadian government bonds since the start of the pandemic and said it wants to hit a net-zero purchase level before it starts to consider raising rates.

In the U.S., investors aren’t pricing in any rate hike by the Federal Reserve over the next year, and only two over the next two years.

There’s a possibility Macklem could move to dampen expectations, to protect against a currency appreciation. The governor and his officials regularly insert heavy doses of caution into their overall positive narrative, to underscore that any withdrawal of stimulus will be gradual and data dependent.

In a May 13 speech titled “The benefits of an inclusive economy,” Macklem said the central bank will continue to support the economy until a “complete” recovery takes place. That includes employment surpassing pre-pandemic levels by about 200,000, he said, as well as a healthy jobs market for groups that have been hit hardest by the pandemic such as young women.

On Wednesday, the bank will probably reiterate a full recovery in jobs will take some time. Officials may even spell out in more detail what indicators they are monitoring to gauge slack in the labor market, according to Stephen Brown, an economist at Capital Economics.

Still, they will also be making one major change to their projections on Wednesday that highlights the limits to accommodating the expansion.

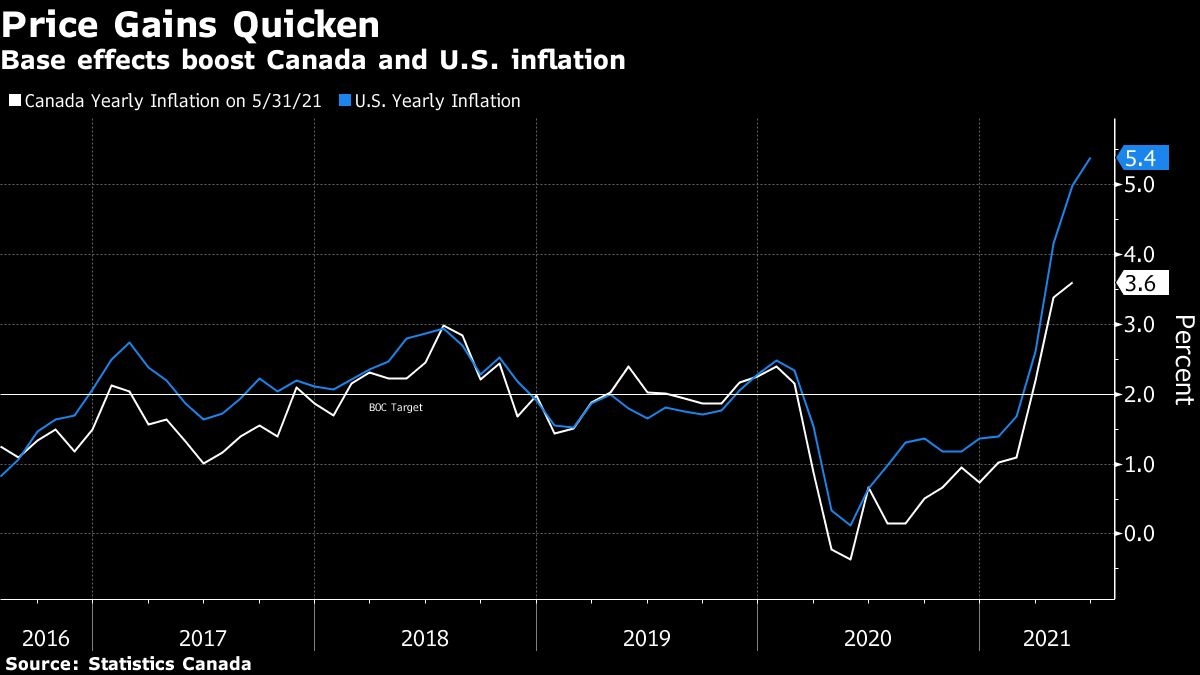

Inflation is running hotter than the central bank predicted only three months ago, and officials will need to revise it higher to well above the central bank’s 2% target through most of the forecast horizon.

The central bank has been brushing off the run up of inflation as temporary. Keeping on the path to normalizing monetary policy will ensure it remains that way.

“The two biggest risks for the meeting are no taper at all, or a faster closure of the output gap than signaled in April,” Ian Pollick, head of fixed income, currency and commodity research at Canadian Imperial Bank of Commerce, said by email. “We see both of these risks as being low probability outcomes.”