Jan 30, 2023

Hong Kong Seeks to Revive Crypto Sector Wrecked by FTX Debacle

, Bloomberg News

(Bloomberg) -- Hong Kong is sticking with a plan to become Asia’s digital-asset capital despite the industry’s tarnished reputation, a stance drawing tentative interest from bruised crypto firms looking for paths to recovery.

The city claims it will learn the lessons of a $2 trillion crypto market rout and a spate of global bankruptcies like the collapse of the FTX exchange to create a fresh regulatory framework that can protect investors and encourage growth.

The three-month-old pivot toward fostering a crypto sector is part of a wider effort to restore Hong Kong’s credentials as a financial center after earlier Covid-related curbs and political unrest sparked a brain drain. But digital-asset businesses have been retrenching of late, posing an obstacle to the city’s push.

Matrixport Technologies Pte, a crypto lender with about 300 staff, is among the firms assessing Hong Kong’s evolving rulebook. Its home base of Singapore is now so wary of virtual coins that it may ban retail-token lending altogether.

Matrixport is already evaluating the possibility of setting up in Hong Kong even as it awaits the outcome of a Singapore virtual-asset license application, according to people familiar with the matter.

Gauging the likely return on the needed investment is hard because Hong Kong’s rules are still evolving, the people added, asking not to be identified as the deliberations are private. A company spokesperson declined to comment.

Hong Kong’s crypto plan includes a mandatory exchange licensing regime due from June and a consultation on allowing retail trading. Officials have also permitted exchange-traded funds investing in CME Group Inc. Bitcoin and Ether futures. Three such ETFs launched since mid-December have raised over $80 million.

“Companies are interested in the prospective crypto regime but also hesitant pending more details,” said Bloomberg Intelligence ETF Analyst Rebecca Sin.

ETF Potential

Sin pointed to longer term potential for asset managers if a currently limited program allowing Chinese investors to buy some stock ETFs in Hong Kong is one day widened to span crypto. Bloomberg Intelligence estimates total funds under management in Hong Kong ETFs may surpass $50 billion by year-end.

Sin expects regulators to permit spot Bitcoin ETFs as early as the second quarter. Samsung Asset Management, which launched the Samsung Bitcoin Futures Active ETF in Hong Kong in January, has indicated it could consider starting a spot fund if the city gives the green light.

The territory is in some ways coming full circle as it used to be a crypto hub in the earlier years of digital assets, courtesy of a then laissez-faire reputation. Discredited former crypto mogul Sam Bankman-Fried’s now-collapsed firms FTX and Alameda Research have Hong Kong roots dating from 2019. Binance Holdings Ltd., the biggest digital-asset exchange, once had a base there.

But signs over the years that officials were taking a tougher regulatory approach, such as restricting crypto exchanges to clients with portfolios of at least HK$8 million ($1 million), led to a rethink among crypto outfits. Then in 2021, China largely banned crypto, dulling the city’s allure as a conduit for mainland cash. Bankman-Fried and FTX decamped to the Bahamas the same year.

FTX’s Shadow

The US has now accused Bankman-Fried of one of the biggest financial frauds at the helm of the fallen FTX group. Contagion from its bankruptcy is still spreading, most recently in this month’s Chapter 11 filing of crypto lender Genesis Global Holdco LLC, which may owe creditors more than $3 billion.

Regulators worldwide are grappling with the dangers exposed by these and other recent crypto collapses. Even so, Hong Kong’s Financial Secretary Paul Chan has said the city remains committed to becoming a regional crypto hub.

A consultation is due this quarter on the guard rails and allowable tokens for retail buyers. Officials are also willing to review property rights for tokenized assets and the legality of the automatically executing, software-based smart contracts that are key for many blockchain-based financial services.

On Tuesday, the Hong Kong Monetary Authority said it plans a mandatory licensing regime for stablecoins by 2023-2024. Stablecoins are tokens that are meant to hold a constant value. The proposed framework would require them to be fully backed by high quality, liquid reserves. Variants that depend on arbitrage or algorithms would be proscribed.

Downturn

A big challenge for Hong Kong’s ambitions is that the virtual-asset industry remains in a deep downturn after a bubble in token prices deflated last year and investors fled. Exchanges Coinbase Global Inc., Crypto.com and Huobi are among a slew of firms that slashed over 1,600 crypto jobs this month.

Another risk is the perception that Beijing is gradually exerting control over the financial hub. China continues to ban most crypto activity on concerns about reckless speculation and the vast amount of energy consumed by the computers that mine tokens and secure blockchain networks.

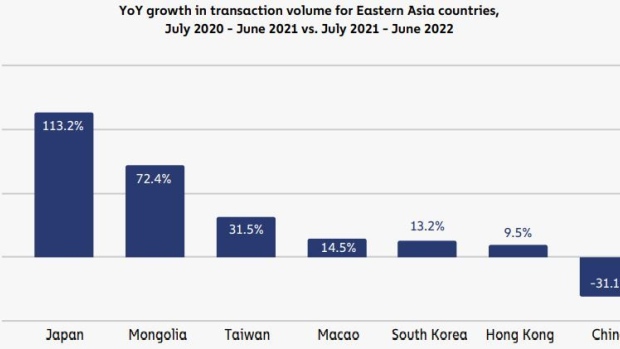

Digital-token transaction volume in Hong Kong expanded less than 10% in the 12 months through June from a year earlier, the least in East Asia outside of a slump in China, according to blockchain specialist Chainalysis Inc. The crypto bear market only worsened in the second half of 2022.

Against that backdrop, many companies are in a holding pattern as they await a recovery and the final version of Hong Kong’s revamped digital-asset rules.

“We’re ready to expand our local operations and add jobs once the road map from the government is more clear on what is allowed and encouraged,” said Justin Sun, who sets strategy for the Huobi exchange. He argued Hong Kong is “becoming the leading force in regulated crypto adoption” in the Asia Pacific.

For crypto market prices: CRYP; for top crypto news: TOP CRYPTO.

--With assistance from Kiuyan Wong and Zheping Huang.

(Updates with proposed stablecoin regulations in the 16th paragraph.)

©2023 Bloomberg L.P.