May 13, 2022

Grayscale’s Bitcoin Fund Hits Record Discount After SEC Meeting

, Bloomberg News

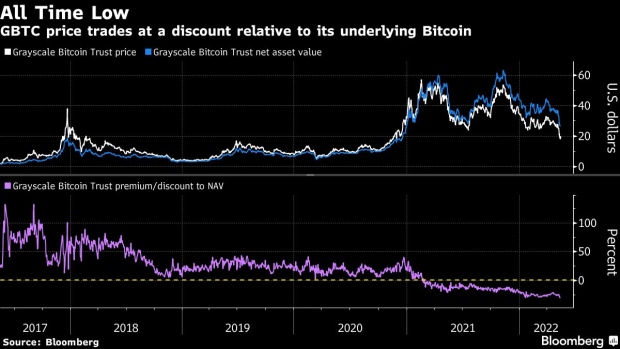

(Bloomberg) -- The world’s biggest crypto fund is trading at its biggest discount to Bitcoin ever as Grayscale Investment LLC pushes to convert it into an exchange-traded fund.

The $18.3 billion Grayscale Bitcoin Trust (ticker GBTC) has plunged over 41% so far this year, outpacing the cryptocurrency’s 34% decline. As a result, GBTC’s price closed almost 31% below the below of the Bitcoin it holds on Tuesday, a record discount, according to Bloomberg data.

That dynamic is one of the reasons why Grayscale is pushing the Securities and Exchange Commission to approve its application to convert GBTC into a physically backed ETF -- a structure that U.S. regulators have yet to approve. Because the trust doesn’t allow for redemptions like an ETF, GBTC shares can’t be created and destroyed to keep pace with shifting demand. That’s effectively turned GBTC into a closed-end fund, which are also prone to such dislocations.

The crypto firm met with U.S. regulators last week to discuss the application ahead of a July 6 deadline, arguing that conversion would unlock as much as $8 billion in value for investors should the discount be repaired. Should the SEC reject the filing, Grayscale Chief Executive Officer Michael Sonnenshein has said the company wouldn’t rule out a lawsuit challenging the decision.

©2022 Bloomberg L.P.