Nov 18, 2022

Goldman Sees Holiday Sales Creating Volatility in Retail Stocks

, Bloomberg News

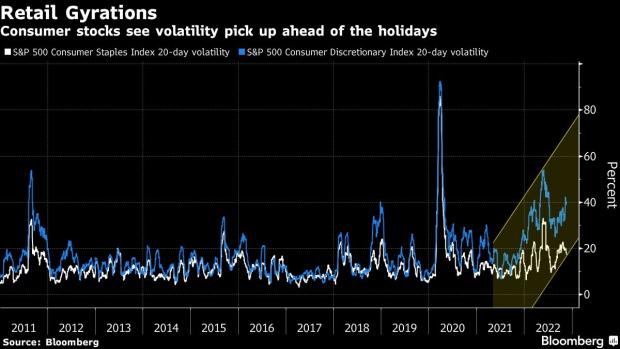

(Bloomberg) -- Thanksgiving holiday sales season is here, and history says that means increased volatility for consumer stocks next week.

From 2011 to 2021, basket of 34 large-cap consumer shares tracked by Goldman Sachs -- including Walmart Inc., Home Depot and Amazon.com Inc. -- saw average swings of nearly 3% in either direction between the day before Thanksgiving and the day after Cyber Monday. By contrast, the $374 billion SPDR S&P 500 Trust (ticker SPY), the world’s largest exchange-traded fund which tracks the S&P, averaged a 1.3% variation.

What’s more, Goldman expects even higher-than-normal holiday-season volatility in consumer stocks this year do to the wide variations in investor expectations.

“We believe option prices on select consumer-focused stocks are attractive ahead of the holiday shopping season around Thanksgiving, Black Friday and Cyber Monday,” Goldman strategists led by Vishal Vivek wrote in a note to clients.

The average stock in Goldman’s consumer basket derived 29% of its revenue in the fourth quarter from 2011 to 2019, compared with 26% for the average stock in the broader S&P 500 Index. Sales were even higher for consumer companies over the past two years -- rising to 31% in the final three months of the year -- since the pandemic drove massive shifts in American’s spending habits, according to the bank.

For instance, retailers like Burlington Stores Inc., Ross Stores Inc. and luxury fashion company Tapestry Inc. saw a sharp jump in revenues in the final quarter of 2020, while airline stocks like United Airlines Holdings Inc and Delta Air Lines Inc. benefited from a return to travel-related spending in 2021.

Heading into this year’s holiday shopping season, Goldman sees the potential for heightened volatility in these names, “driven by an uncertain macro environment and reversals from the prior two years of pandemic-induced spending,” Vivek wrote.

“Following a decline in implied volatility in these stocks over the past month, we believe long option strategies on these names are attractive in the near-term,” he added.

Separately, Goldman surveyed 1,000 US consumers about their plans for holiday shopping. Overall, results point to a choppier season, with 46% of consumers planning on spending less.

The bank, however, sees the potential for outperformance in select corners of the consumer market, including companies that offer steep discounts since survey respondents indicated a “willingness to trade down to lower price/quality products” as consumers hunt for cheaper prices in the face of decades-high inflation.

©2022 Bloomberg L.P.