Jun 2, 2023

Goldman Sachs Takes Aim at JPMorgan’s Billions With Copycat ETFs

, Bloomberg News

(Bloomberg) -- The runaway success of JPMorgan Chase & Co.’s actively managed exchange-traded fund lineup has Goldman Sachs Group Inc. playing catchup.

The Goldman Sachs U.S. Equity Premium Income and the Goldman Sachs U.S. Tech Index Equity Premium Income ETFs will invest primarily in US stocks and also use a derivatives strategy known as call writing, according to applications filed Thursday.

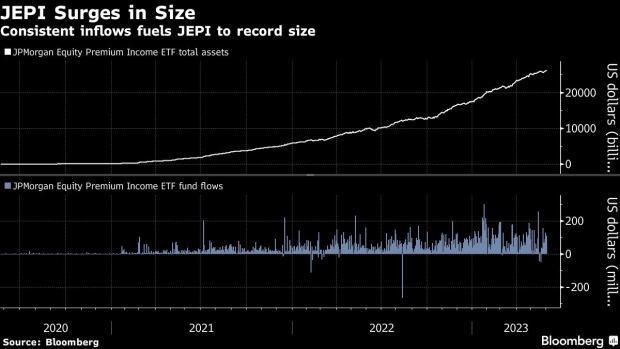

The proposed ETFs bear a striking resemblance to two of JPMorgan’s standout products: the $26 billion JPMorgan Equity Premium Income ETF (ticker JEPI) and the $3.3 billion JPMorgan Nasdaq Equity Premium Income ETF (JEPQ), which also track US stocks and sell call options. Goldman could be trying to capture some of its rival’s blockbuster hauls. JEPI has brought in nearly $9 billion this year — the most of any active ETF — while JEPQ is in second place with $2 billion of inflows so far in 2023.

To Todd Sohn of Strategas, Goldman faces an uphill battle given the popularity and name recognition of JPMorgan’s income-focused funds.

“Imitation is flattering, especially within ETFs, but it’s usually about being a first mover and putting marketing and distribution muscle behind it,” said Sohn, an ETF strategist. “Everyone knows JEPI, it’s like muscle memory.”

Spokespeople from Goldman and JPMorgan declined to comment. Tickers and fees for the Goldman funds, both of which will be actively managed, aren’t yet listed.

Active ETFs have attracted unprecedented amounts of cash this year against a backdrop of equity markets that are running hot and cold as the Federal Reserve nears the end of its tightening campaign. Actively managed strategies have attracted more than a quarter of the roughly $149 billion of inflows into US ETFs this year — a record share.

Booming demand for such strategies has been a windfall for JPMorgan. JEPI became the largest active ETF this year, displacing another JPMorgan fund, the $24.6 billion JPMorgan Ultra-Short Income ETF (JPST), for the top spot.

That growth has helped JPMorgan climb the ETF issuer US leaderboard. Its share of total ETF assets currently stands at 1.6% of the roughly $7 trillion industry versus 0.6% at the end of 2018, data compiled by Bloomberg Intelligence show. By contrast, Goldman’s share has stalled out at 0.4%, compared to 0.3% five years ago.

“It’s hard to bet against Goldman given their size, brains and distribution but this is really late in the game to be filing for this particular strategy,” said Bloomberg Intelligence senior ETF analyst Eric Balchunas. “They seem to have lost their edge when it comes to the ETF market, whereas JPMorgan is all edge.”

©2023 Bloomberg L.P.