Mar 30, 2023

Goldman’s Rubner Sees Stocks Primed for Further Gains in April

, Bloomberg News

(Bloomberg) -- With Wall Street strategists struggling to figure out what the recent bank crisis will mean for US stocks, Goldman Sachs Group Inc.’s Scott Rubner says equities are headed for more gains, at least in April.

Bearish positioning at hedge funds and among retail investors delivers a technical setup that points to a continued advance in the S&P 500, according to Rubner. His analysis tracks fund flows, a research technique that’s gained traction lately as investors try to get a firm grip on the path of the economy and monetary policy.

“There is simply too much going on in the ‘macro’ to have a confident trading call, but I am bullish equities for April,” the market veteran who has studied flow of funds for two decades wrote in a note to clients. “Current positioning is too short, too low VAR, low net,” he added, referring to the notion of value at risk. “If the macro were to improve, we think that the pain trade goes back to the upside. This is a change in tone.”

Rubner warned that Friday’s trading may be choppy amid quarter-end rebalancing from pension funds and options hedging activity.

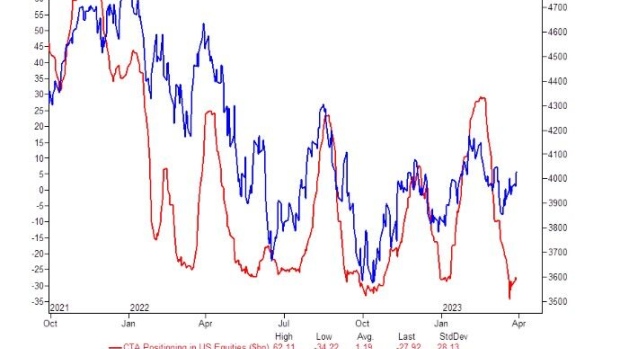

Once that turbulence clears, his analysis expects that commodity trading advisers, or CTAs that surf the momentum of asset prices through long and short bets in the futures market, could be forced out of bearish stock bets. The trend-following cohort currently is betting about $26 billion against the S&P 500, near the largest short position since at least October 2021.

Breaking the group’s potential supply and demand into six brackets based on various market moves and time frames, Rubner’s model shows these momentum-chasing quants would snap up shares under each of the scenarios.

“It is a green sweep for the S&P 500 with potential demand in 6 out of 6 scenarios,” he wrote. “CTA equity demand is simply the most important chart of my deck. It is a great American BBQ party. You do not see this very often.”

The S&P 500 rose 0.6% Thursday, pushing its gain in March to 2%. It has recouped all losses since the banking crisis erupted on March 8.

Even after the latest gains, skepticism has persisted after investors suffered through a peak-to-trough decline of 25% as the Federal Reserve carried on aggressive monetary tightening to fight inflation. In the latest Bank of America Corp. survey of money managers this month, allocation to US stocks fell to an 18-year low.

Among individual investors, pessimism also prevailed. For a 15th straight month, the percentage of consumers expecting lower share prices in the year ahead exceeded those expecting higher stocks, based on the Conference Board’s monthly survey. That’s the second-longest streak of negative sentiment in data going back to 1987, behind only the 18-month run during the global financial crisis, according to Bespoke Investment Group.

All the defensive positioning set the stage for equity gains, according to Rubner, because sellers are likely close to exhausted and even a small dose of positive news can spark a wave of buying when bears are forced to chase the upside.

But before all that could happen, Rubner sees a couple quarterly events for the stock market to clear on Friday. One is some options expiry that will release market makers from a “long gamma” stance that requires them to sell stocks when they rise, or vice versa, in order to stay market neutral. By Goldman’s estimate, options dealers are currently long more than $6 billion worth of index gamma, the most since November 2021, and will see it decline by half next week.

The other is the expected equity selling of $2.3 billion from pensions that need to reset asset allocation to prior levels following the latest cross-asset volatility.

“This clears up,” Rubner said. “Equity market flow of funds technicals are extremely favorable starting tomorrow at 4pm EST.”

©2023 Bloomberg L.P.