Apr 24, 2024

European Stocks Turn Lower on Worries Over Earnings, Geopolitics

, Bloomberg News

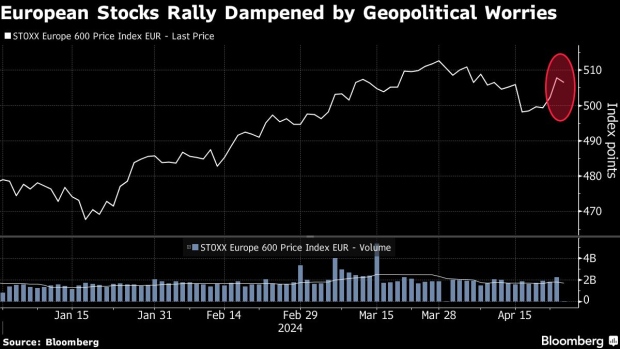

(Bloomberg) -- European stocks fell on Wednesday as a rally in tech stocks ran into a post-earnings pullback in Kering SA and Roche Holding AG, as well as heightened worries over geopolitics.

The Stoxx Europe 600 Index closed 0.5% lower in London, a day after its strongest session since January. Technology stocks outperformed as chipmakers rallied on Texas Instruments Inc.’s outlook, which suggested that a slump in demand for industrial components may be easing. Miners also pushed basic resources sector higher.

Among the heaviest decliners, Kering slumped as much as 10% after warning that profit will plunge in the first half, dragging other luxury stocks lower. Novo Nordisk and Roche took the most points out of the pan-European index after a disappointing trading update. UBS Group AG also fell as it held its AGM and Citigroup downgraded it on worries around capital requirements as well as high valuation.

Geopolitical worries also mounted on Wednesday as Israeli military said it struck around 40 sites linked to Hezbollah in southern Lebanon, an attack that seemed more intense than its most recent ones.

Goldman Sachs Group Inc. strategist Sharon Bell said geopolitical concerns are top of mind for every investor she talks to, speaking earlier to Bloomberg Television, adding that gold and the dollar have been good hedges. Concerns over ongoing conflicts and rate cuts have weighed on European stocks in April after a strong start to the year.

“The context of recent market jitters is also important,” she said. “A risk adjustment is neither unexpected nor unwelcome, as it makes a sustainable continuation of the current bull market more likely,” said Skylar Montgomery Koning, senior global macro strategist at TS Lombard.

For more on equity markets:

- Volatility Drop Offers Another Chance to Hedge: Taking Stock

- M&A Watch Europe: Allfunds, Recordati, Sanofi, Hochtief, Puig

- Vivendi’s Split Plan Is a Slow Burner for Investors: ECM Watch

- US Stock Futures Rise; Tesla, Stride, Texas Instruments Gain

- Sweet Deal Alabama: The London Rush

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

©2024 Bloomberg L.P.