Jan 17, 2022

Europe’s Smelters Call for Action to Combat Soaring Energy Costs

, Bloomberg News

(Bloomberg) -- A group of Europe’s leading metal producers has called on the continent’s politicians to deploy a package of measures including state aid and tapping national gas reserves to ease the regional power crisis and avert further smelter shutdowns.

Eurometaux, which represents producers including Glencore Plc, Rio Tinto Group and Norsk Hydro ASA, sent a letter to the European Commission warning that more producers could be forced to cut output or shutter plants entirely without additional support to protect smelters from the surge in power costs.

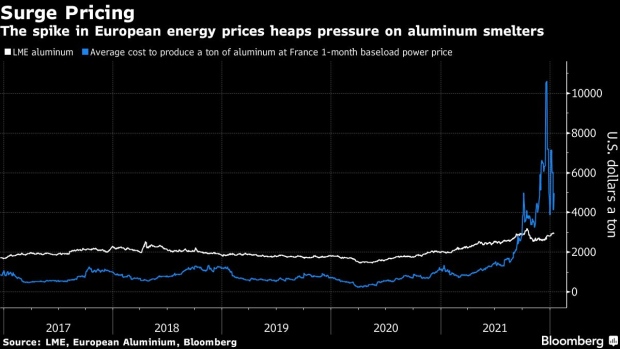

Aluminum and zinc producers have been hit particularly hard by soaring gas and electricity prices, with smelter cutbacks and closures over the past few months sparking regional shortages and sending product prices sharply higher. About 650,000 tons of aluminum capacity has been curtailed due to the crisis already, which equates to about 30% of the region’s total, the group said in the letter.

While power prices have retreated from last month’s peaks, smelters are still exposed to heavy losses from the spot market in countries like France. Europe’s gas inventories, meanwhile, are way below the levels usual for this time of year, with a lack of supply from Russia creating the risk of further price spikes through the winter.

In the letter, Eurometaux suggested using national gas reserves to stabilize the market, as well as measures to make sure that carbon prices don’t rise too high or too quickly as ways to lower costs.

The group also called on the commission to rapidly develop a state-aid framework to provide further short-term support, similar to temporary measures rolled out during the Covid-19 pandemic.

“Without stronger EU and member state action, there is a real risk of further curtailments and closures in our sector, to the detriment of Europe’s strategic autonomy goals,” the association said in the letter. “A lot more now needs to be done, both to stop the impact of the current crisis and to avoid repeat situations in the years ahead.”

©2022 Bloomberg L.P.