Mar 5, 2021

ETF buyers prefer emerging stocks over U.S. shares, gold, bonds

, Bloomberg News

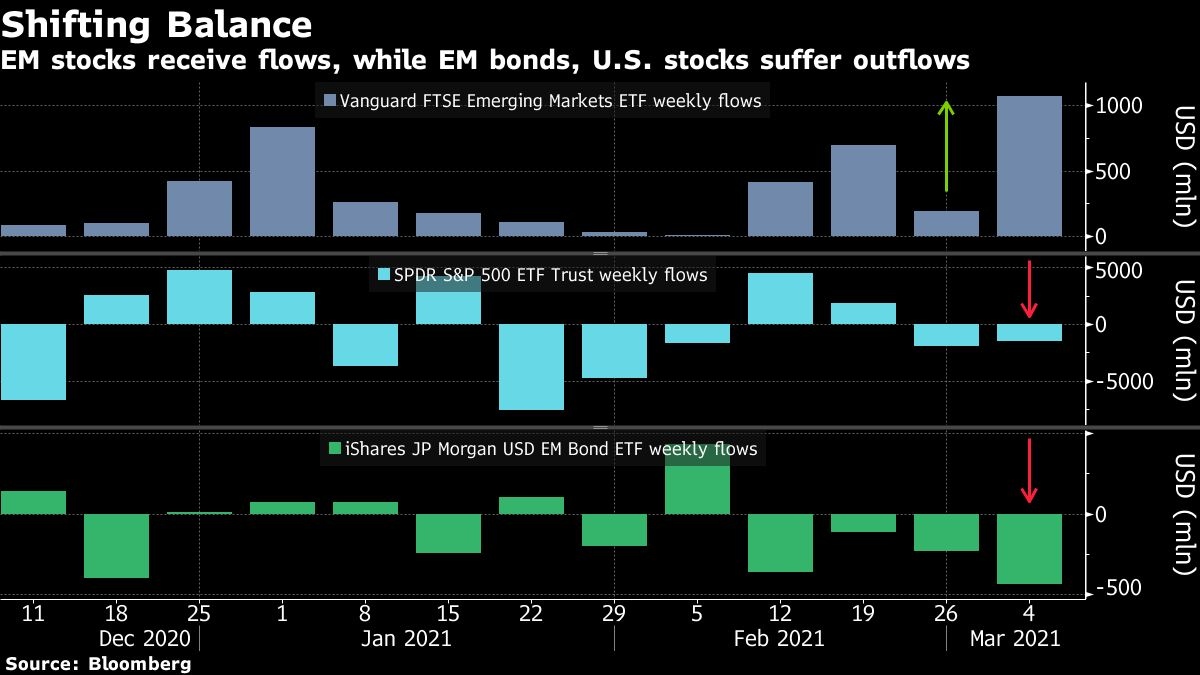

If capital flows into U.S. exchange-traded funds are any indication, investors have begun to favor emerging-market stocks over almost every other asset class -- including U.S. equities.

The largest ETF buying developing-nation shares received more money in the five days through Thursday than any of the more than 2,400 other funds in U.S. exchanges, according to data compiled by Bloomberg. That’s sending the Vanguard FTSE Emerging Markets ETF toward its biggest weekly inflow in two years.

In contrast, the US$324 billion SPDR S&P 500 ETF, the flagship for U.S. equities, witnessed outflows exceeding US$4.5 billion, the worst among peers. Other funds investing in Nasdaq 100 Index shares, gold, silver, real estate, global bonds and inflation-linked securities all lost money. Dollar debt, usually the most popular segment within emerging markets, is also losing out to stocks now.

Money managers from Ashmore Group Plc to JPMorgan Chase & Co. and UBS Group AG have been making a bull case for emerging-market equities in 2021 as they expect the group to be the prime beneficiary of the post-coronavirus economic rebound. Asia’s relative success in containing the pandemic, vaccine breakthroughs in China, India and Russia, as well as renewed demand for commodities and Joe Biden’s US$1.9 trillion stimulus plan are underpinning the optimism.

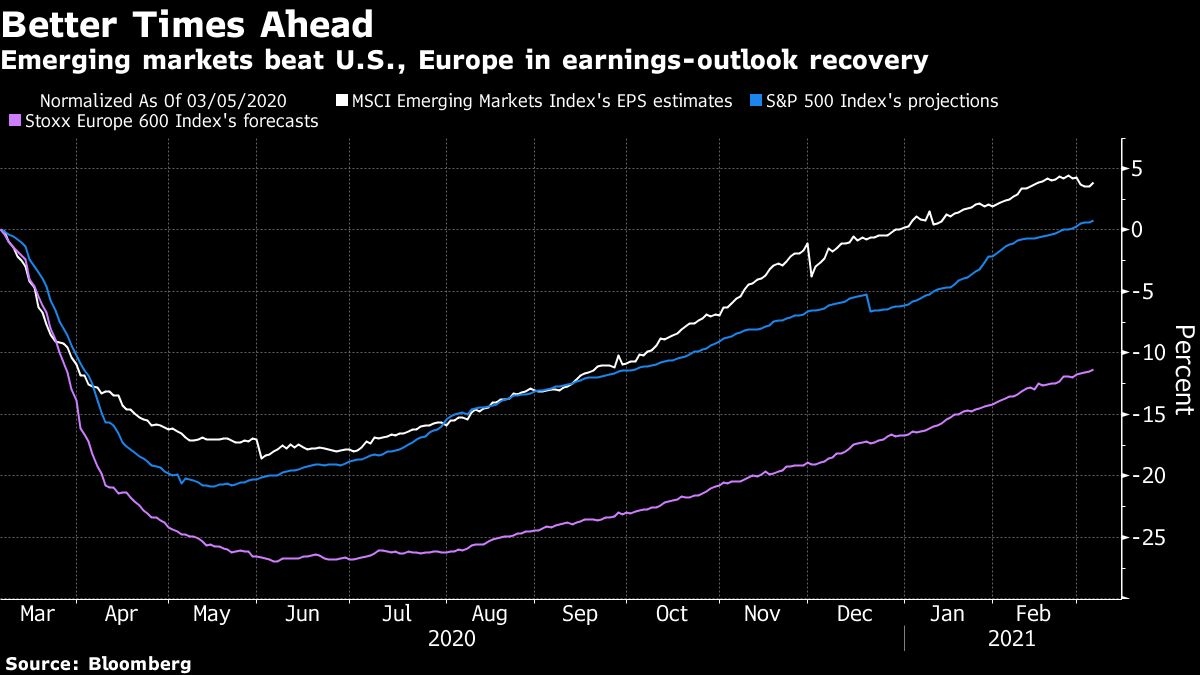

Analysts have been raising earnings estimates for emerging-market companies faster than for rich nations. After a meltdown in March 2020, profit forecasts have recovered a net 4 per cent in the developing world. Projections are little changed in the U.S., while they are still 11 per cent lower in Europe.

Then there’s the valuation appeal. Emerging-market equities trade at an almost 29 per cent discount to U.S. stocks, compared with an average of 25 per cent in the past 15 years. To some investors, that leaves room for the rally in the benchmark MSCI Emerging Markets Index to continue at least until that gap is closed.

That’s not to say the gauge can continue to advance amid a selloff in the U.S. Any slide in developed nations has an immediate and outsized impact on emerging markets. Still, the better earnings outlook and cheaper relative valuations support the case for outperformance beyond the short term.