Jun 16, 2022

ESG Investment Cools as the Sector’s Notoriety Grows

, Bloomberg News

(Bloomberg) --

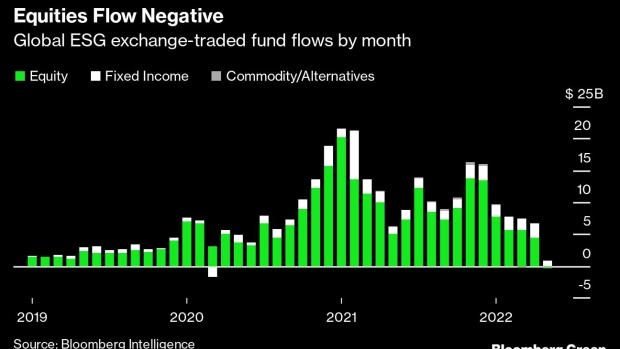

Since the start of 2019, investors have plowed more than $300 billion into environmental, social and governance (ESG)-themed exchange traded funds. Monthly investment has ebbed and flowed, but the annual trend has been on a consistent upward trajectory: $30 billion in 2019, $94 billion in 2020, and $159 billion in 2021.

Something happened this May, however. The biggest class of ESG ETFs had outflows for the first time in almost six years.

Bloomberg tracks three types of ESG exchange-traded funds: equities, which hold stock in companies; fixed income, which hold bonds; and commodities and alternatives, which hold … commodities as well as hedge funds, real estate and infrastructure funds. Total ESG inflows last month were barely positive, relatively speaking — about $400 million, whereas flows in 2021 averaged $11 billion and twice topped $20 billion. More importantly, equity flows were negative, with a bit more than $200 million leaving the universe of ESG ETFs.

Last month’s negative flow is also striking in the context of just how much money was going into ESG ETFs only a year and a half ago. In January 2021, more than $20 billion poured into ESG equity ETFs, a high-water mark that no other month of fund flows even approaches. The trend has been steadily downward for six months.

The resulting decline in equity ETF net flows — and the plateau in cumulative flows to the asset class — means that 2022 is now running behind 2020, and investment is at less than one-third the pace of 2021.

If May 2022 was a nadir in one way, it was an ESG peak in another. Using Google Trends to track ESG interest over time shows that last month was the high point for web searches for the term in the past five years. Looking at the data, we see a dramatic spike in the week of May 15.

It isn’t hard to find reasons why. On May 18, none other than Elon Musk described ESG as a “scam” that “has been weaponized by phony social justice warriors.” A day later, an HSBC executive said that “climate change isn’t a financial risk that we need to worry about,” adding a series of colorful attacks on sustainable investing approaches in general (the bank swiftly suspended him as a result).

Correlation (negative, in this case) isn’t causality, of course. But it is worth considering that a peak in ESG interest, coinciding with two highly public and decidedly negative statements on the very nature of environmental, social and governance, might lead institutional fund managers to question their recent allocations. Elon Musk has legions of fans, many of whom might invest based on his stated position on ESG, and retail investors are “slowly starting to look under the hood” of the industry and not always liking what they see, as Bloomberg’s Natasha White and Frances Schwartzkopff recently reported. But the fund flows that Bloomberg tracks are almost entirely those of institutional investors, not retail investors acting on their own behalf.

It’s also worth considering that some institutional fund managers may be seeking returns elsewhere. The S&P Oil & Gas Exploration & Production ETF was up 68% year to date through June 7, with a significant portion of that run-up happening in May.

And there is a final factor to take into account: a regulatory crackdown. It emerged last weekend that the US Securities and Exchange Commission is investigating the ESG claims of the asset-management unit of Goldman Sachs Group Inc., after the agency announced “a slate of new restrictions Wednesday aimed at ensuring ESG funds accurately describe their investments.” At the end of May, German police raided the offices of Deutsche Bank AG and DWS Group over allegations of greenwashing.

The ESG reality lies somewhere between a politically weaponized scam and an investing nirvana with perfect clarity and transparency. As that reality resolves itself — through investors’ decisions, regulatory scrutiny and perhaps still a tweet or two — ESG fund flows may find their new normal.

Nathaniel Bullard is BNEF’s Chief Content Officer.

©2022 Bloomberg L.P.