Jun 18, 2022

ESG Funds Resist Worst of Downturn But Investors Are Spooked

, Bloomberg News

(Bloomberg) -- For sustainable investors browbeaten by the recent attacks on the industry, fund performance may offer a bit of reprieve.

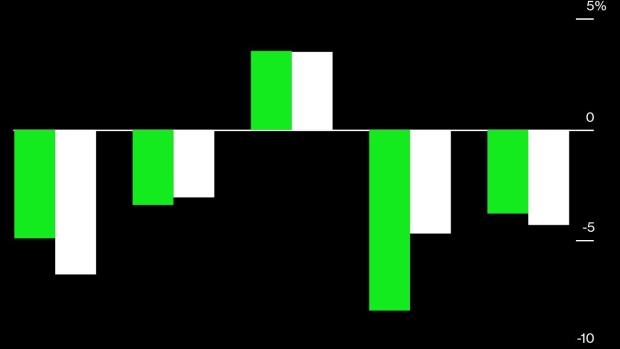

In three broad categories — Europe-focused, US-focused and global — ESG equity funds have done better this year, on average, than their non-ESG counterparts. All are negative, in line with the broad market selloff, but ESG funds are down less than the others, in spite of typically tech-heavy, energy-light portfolios.

ESG proponents insist that using environmental, social and governance metrics in investing decisions can drive returns — or at least won’t drag them down. Others aren’t so sure. The rapid growth in ESG funds coincided with a bull market that ended in 2022, making this lull a test for portfolio managers and investors alike.

“For the first time in a long time, ESG companies are going be at the mercy of the market, not at the mercy of ESG,” said James Penny, chief investment officer at TAM Asset Management. Until now, “you could have just bought any ESG fund and it would’ve done the job, but because of the environment, you’ve got to do that from the ground up and actually earn your corn as a manager.”

Investors are rattled. A market slump in May was matched by record ESG outflows. Investors withdrew $2 billion from ESG-labeled exchange-traded equity funds, according to Bloomberg Intelligence. In terms of assets, funds focused on environmental, social and governance factors are down 20.5% so far this year, slightly more than the 19% drop in general funds, according to data compiled by Bloomberg.

ESG investors are also paying higher fees for their investments, creating a further test for returns. For stock index funds — typically marketed as cheap and easy to access — ESG investors pay more than twice the average for equity index funds, according to data from analytics firm Morningstar. (Actively managed ESG funds cost roughly the same as their non-ESG counterparts.)

Investors might be happy to pay more when returns are good. But priorities change in turbulent markets. In an RBC survey of 900 investors based in the US, almost half said financial performance and returns were more important than ESG impact, up from 42% who said so last year. In a separate survey, Charles Schwab Corp. found 66% of retail investors in the UK don’t care whether their allocations are sustainable, and instead only want to maximize profits.

Investors are focused on the short term right now, said Penny. “You’ve got interest rates which are rising. You've got a cost of living crisis. Investors are far more concerned about not losing money than making 10% or 20%,” he said.

Tech stocks made up a quarter of global ESG fund holdings at the end of April, more than in their non-ESG counterparts, according to fund analytics firm EPFR, and industry returns are down by about a third this year. The biggest ESG-labeled ETF, BlackRock iShares ESG Aware (ticker ESGU), has 28% of its portfolio allocated to tech; it’s lost 24% this year.

At the same time, ESG funds tend to avoid or minimize exposure to energy stocks, so they’ve missed the recent boom in commodities.

More troubling is ESG funds’ long-term performance. Global ESG funds have underperformed the broader market in the past five years, returning an average of 6.3% per year, compared with 8.9% for broader funds, according to data compiled by Bloomberg. An investor who put $10,000 into an average global ESG fund in 2017 would have $13,573 today, roughly $1,720 less than if they’d put it into a non-ESG portfolio.

The same is true for investors in US and Europe-focused funds. US ESG funds returned 10.2% per year on average, compared with 12.6% for broader funds; European portfolios were up 3.8% per year on average, slightly less than the 4% average annualized return for non-ESG offerings.

For now, there’s still enthusiasm for ESG, said Paulo Salazar, co-head of emerging market equities at Belgium-based Candriam. “I don't see the ESG trend being impacted” by this downturn, he said. “The interest continues to be very high.”

At the same time, it might be good for investors to realize that ESG stocks are also subject to market gravity, said Duncan Lamont, head of strategic research at Schroders. “But the long-term structural drivers [for sustainable investment] are really there.”

©2022 Bloomberg L.P.