Jun 29, 2022

ECB’s Wunsch Says Government Aid May Spell More Rate Hikes

, Bloomberg News

(Bloomberg) -- The European Central Bank may need to raise interest rates by more than it wants if record inflation prompts governments to spend ever-increasing amounts on shielding households, according to Governing Council member Pierre Wunsch.

Support to cushion the spike in energy costs will probably outstrip what’s currently envisaged in economic projections, the hawkish official said in an interview at the ECB’s annual policy retreat in Sintra, Portugal.

He warned that would also boost the danger of unwarranted panic in government bond markets, known as fragmentation, which the ECB is trying to avoid as it lifts borrowing costs for the first time in more than a decade.

“If fiscal policy remains supportive, then we have to do more,” said Wunsch, who heads Belgium’s central bank. “The end game is higher deficits and higher interest rates, and therefore also a higher risk of fragmentation.”

The comments are a response to the trillions of euros governments have spent to shield companies and households -- first through the pandemic and now through the historic surge in prices. The outlays have been possible because European Union limits on spending remain suspended through 2023 due to the war in Ukraine.

Wunsch’s fiscal-policy worries reflect heightened alert at the ECB over market gyrations following a recent blowout in Italian yields that eased only after a pledge to complete work on a new anti-crisis tool.

Before that’s unveiled, President Christine Lagarde said Tuesday that a first line of defense -- flexible reinvestments of maturing bonds from a 1.7 trillion-euro ($1.8 trillion) pandemic portfolio -- will be activated later this week.

ECB staff are working on an instrument that may be presented at the Governing Council’s July 20-21 meeting. While the final details are unclear, officials stress that it must be large enough to be credible, while not hampering efforts to tackle inflation.

Wunsch said a “backstop instrument” is needed. “It’s hard to think about unwarranted fragmentation that would justify us being present in the markets on a permanent basis.”

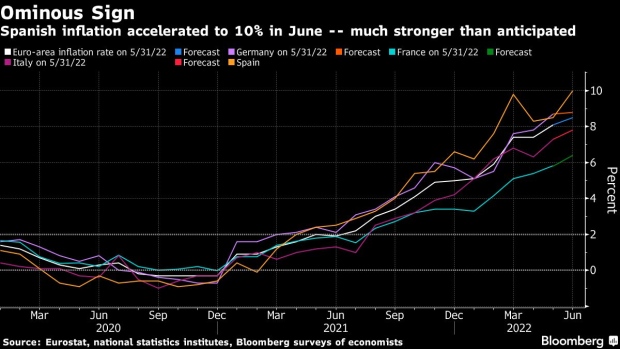

Before any announcement, data on the latest inflation trends across the 19-member currency bloc are being released. Figures Wednesday from Spain showed prices rocketed at a record 10% pace this month. Euro-area numbers are due Friday and are also expected to reveal another all-time high of 8.5% -- more than four times the 2% target.

“We need to act in a clear and forceful manner,” Wunsch said.

Current plans envisage a quarter-point rate hike in July followed by a bigger step in September if the inflation backdrop doesn’t improve. There’ll then be a series of “gradual but sustained” increases after that.

“We can be gradual in some way, but our definition of gradual explicitly makes room for hikes that are bigger than 25 points,” Wunsch said.

Asked whether a larger move could be considered next month, as suggested by Governing Council members Martins Kazaks and Gediminas Simkus, he said: “No. I think July is a done deal.”

After the comments from Simkus on Wednesday, money markets are now pricing 161 basis points of hikes this year, compared with 164 a day earlier. Wunsch called expectations for about 150 basis points by March “reasonable.”

“If we are still in an environment without a deep recession and year-on-year growth being positive, I think the first 200 basis points are a no-brainer,” he said.

©2022 Bloomberg L.P.