Nov 9, 2022

Disney erases almost all its pandemic gains after earnings miss

, Bloomberg News

Disney+ raises streaming price by 38%, offers plans with ads

Walt Disney Co. shares fell the most September 2001, dragged down by disappointing advertising sales and costly streaming programming.

Losses at the company’s direct-to-consumer arm, driven by its Disney+ service, more than doubled to US$1.47 billion in its fiscal fourth quarter, due to higher programming expenses and the cost of global expansion. Weakness in cable-television advertising revenue also hurt Disney’s performance.

Sales, at US$20.2 billion, came up about US$1 billion short of analysts’ projections. Earnings, excluding certain items, fell to 30 cents share, missing the average estimate of 51 cents from analysts surveyed by Bloomberg.

Disney shares fell 13 per cent on Wednesday to US$86.75, the lowest closing price since March 2020. That’s the biggest one-day drop since Sept. 17, 2001, the day markets reopened after the terrorist attacks.

Chief Executive Officer Bob Chapek, nearly three years into that position, faces a pivotal moment where the company’s massive investments in streaming need to pay off. Chapek reiterated his forecast that Disney+ will be profitable in fiscal 2024. He said price increases and the introduction of a new ad-supported version will help the company’s direct-to-consumer unit reach that goal.

“Our financial results this quarter represent a turning point as we reached peak DTC operating losses, which we expect to decline going-forward,” Chapek told investors on a call Tuesday.

Although spending on content will remain near US$30 billion next year, the company is seeking to reduce expenses in other areas of its business, such as marketing. Core Disney+ subscribers will increase only slightly in the first quarter, Disney said, before accelerating in the second quarter. The company forecast high-single-digit growth in operating income and sales for fiscal 2023.

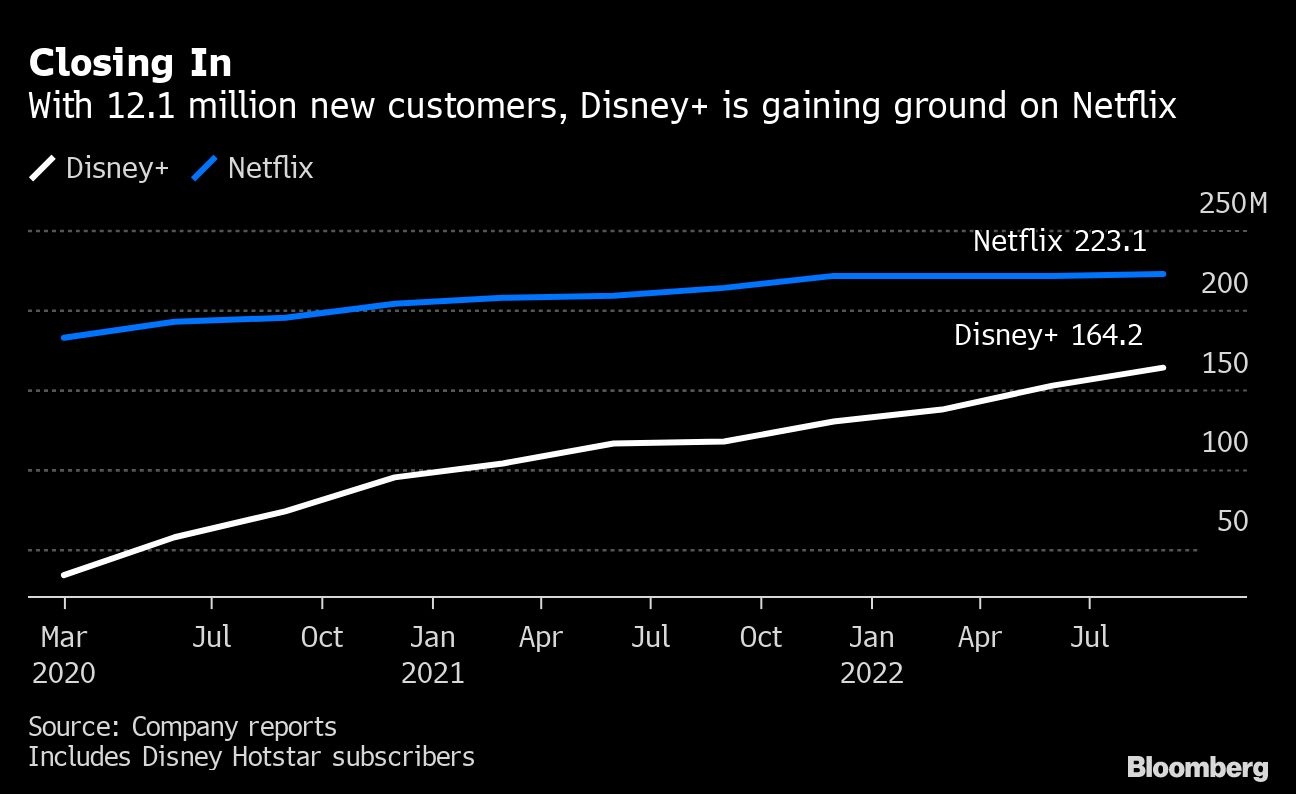

The company beat expectations for streaming subscriber additions in the fourth quarter, signing up 12.1 million new customers at its flagship Disney+ service alone. Total subscribers, including those for its Hulu and ESPN+ products, rose to almost 236 million. Those numbers come after rival Netflix Inc. beat internal forecasts as well as Wall Street expectations in the most recent quarter, adding 2.41 million customers.

Disney has made streaming a major focus for growth. On Dec. 8, the company will begin selling the ad-supported version of Disney+ at a monthly price of US$8. The price of its ad-free version will jump 38 per cent to US$11 per month. The company reported a decline in its average revenue per Disney+ subscriber, as more customers subscribed through a discounted bundle with the company’s other services. The bundled offering now makes up about 40 per cent of domestic subscribers.

“Our experts say that ad-tiers can be more profitable for Disney+ than its traditional tier,” Third Bridge analyst Jamie Lumley said, adding that “Disney is in a better position than Netflix” because of existing ads infrastructure through Hulu and ABC.

Profit at Disney’s theme-park unit more than doubled to US$1.51 billion, due to higher attendance and increased guest spending, but fell short of what analysts were projecting. Hurricane Ian reduced operating income by US$65 million.

“The parks number is much lower than we expected,” Bloomberg Intelligence analyst Geetha Ranganathan said on Bloomberg TV. Inflation could be crimping consumer demand in what has been a strong growth area.

“These results don’t look that rosy anymore,” Ranganathan said.

Revenue from Disney’s traditional TV business, which includes networks such as ESPN and ABC, fell 5 per cent in part due to ad sales weakness. Profit rose 6 per cent to US$1.74 billion due to lower programming costs in cable TV, particularly for sports. Disney reduced the number of Major League Baseball games it aired this season under a new contract.