May 31, 2023

Currency-Hedged ETF Focused on Japan Set For Best Month of Flows Since 2017

, Bloomberg News

(Bloomberg) -- Traders are piling back into a Japan-focused stock ETF that strips out foreign-exchange volatility, seeking to seize on the country’s equity-market rally without the risk of the yen weakening further against the US dollar.

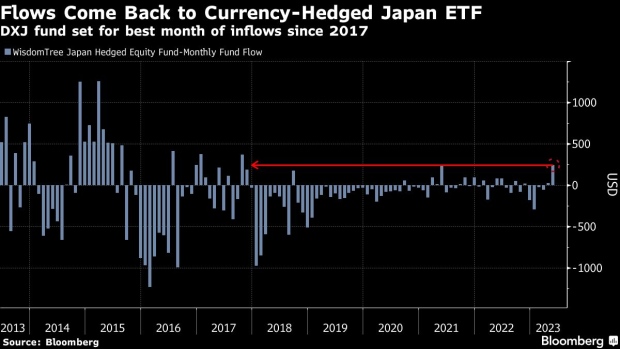

After seeing cash pulled out for most of the year, the WisdomTree Japan Hedged Equity Fund (ticker DXJ) is on track for its best month of inflows since October 2017, raking in roughly $242 million in May. The nearly $2 billion ETF has gained about 19% in 2023, outperforming its unhedged peers.

The fund invests in a basket of Japanese stocks while hedging against weakness in the yen, which could appeal to US investors worried their gains will be wiped out if the dollar strengthens due to the higher interest rates in the US. The yen weakened against the US dollar by some 2.5% in May, while Japan’s Nikkei 225 stock index notched its best month since November 2020.

A combination of the country’s improved economic outlook, Warren Buffett’s interest and the Tokyo Stock Exchange’s push for companies with low valuations to improve governance has propelled the Nikkei 225 Index to the highest levels since 1990. Meantime, the yen has weakened against the dollar as the Bank of Japan holds interest rates low, breaking from the hawkish shift taken by the Federal Reserve and other central banks.

“I think Japan finally matters again for global investors,” said Win Thin, the global head of currency strategy at Brown Brothers Harriman. “Growth is solid,” he said, “while the BOJ is showing no signs of pivoting yet.”

The divergence helped currency-hedged ETFs outperform their unhedged peers. While DXJ doesn’t have an exact counterpart, the iShares Currency Hedged MSCI Japan ETF (HEWJ), which holds similar Japanese stocks, has beaten its unhedged peer by over 9 percentage points this year.

Read more: Japan Stocks May Reach Record High in Early 2025, BofA Says

“This could be a small awakening for currency-hedged ETFs,” said Athanasios Psarofagis, ETF analyst at Bloomberg Intelligence. “International outperformance and dollar strengthening is ideal for currency hedging.”

He emphasized, however, that many investors poorly timed their trading in currency—hedged ETFs during the last decade, which may keep interest lackluster compared with previous periods of dollar strength.

©2023 Bloomberg L.P.