Apr 26, 2024

Chinese Bond Funds Are Limiting Inflows Amid Buying Frenzy

, Bloomberg News

(Bloomberg) -- A growing number of fixed-income funds in China is setting limits on investor inflows, seeking to manage expectations amid a demand spike in the world’s second largest bond market.

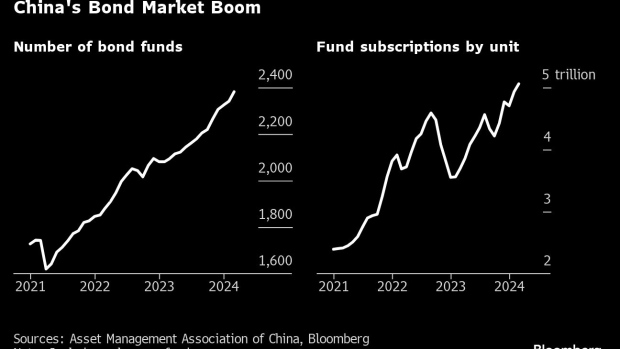

Since March 25, more than 240 of the 2,382 total that operate in the country have imposed limits on subscriptions, according to fund managers’ statements and data from the Asset Management Association of China.

Such a spike in numbers highlights the challenges that funds face to maintain high returns for customers amid a surge in demand for fixed-income assets.

“The frenzy of China’s bond market is the main reason why there is an obvious increase of large purchase limits from many mutual funds,” said Yang Aibin, general manager of Pengyang Asset Management Co. Considering risk control by limiting large subscriptions “is a rational choice, and it’s good for the interests of existing holders.”

The move to set limits isn’t new as fund managers seek to avoid the pressure of maintaining high returns brought on by unsustainable demand. China’s bond market has been surging since November, partly reflecting a lack of attractive investment alternatives in the country.

Bloomberg’s calculation in the number of funds limiting inflows excludes some announcements that reference spring holidays, when the limit may have been related to operational disruptions on off-days.

Strong interest from both institutional and retail investors pushed up subscriptions to bond funds to over 5 trillion units last month, according to AMAC data. Funds in China are normally set up with 1 yuan allocated for each unit.

Earlier this week, the People’s Bank of China stepped up its warning against the rally in long-term government bonds after the yield on 30-year notes tumbled to the lowest level in decades.

With the restrictions in place, mutual funds will likely refrain from buying more bonds. But the impact of the pause in purchases will be offset by demand from wealth management products and insurers, said Guosheng Securities Co. analyst Yang Yewei.

“The restrictions will be removed once the bond market cools down,” he said.

©2024 Bloomberg L.P.