Apr 23, 2024

China’s Credit Yields Drop to Record Lows on Bond Bull Run

, Bloomberg News

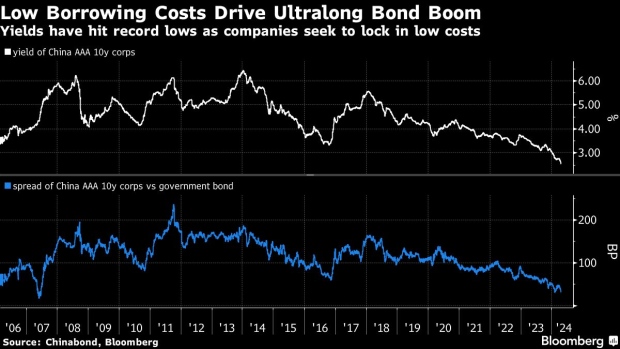

(Bloomberg) -- China’s local credit yields have fallen to the lowest level ever as investors load up on corporate bonds to boost returns in a financial system awash in liquidity.

The average yield of China’s onshore three-year AAA rated corporate notes has dropped 26 basis points this month to a record low of 2.25%, according to a ChinaBond index. Those of longer tenors, including 10-year and 20-year notes, are following the same trend.

Policy steps to stimulate economic growth, such as unleashing more long-term cash for banks earlier this year, have fueled an unusually strong bond rally, with yields of China’s 30-year government bonds approaching a 19-year low. Meanwhile, fixed-income investors are finding limited high-yield options as authorities’ work to resolve local government debt risk.

Yields in China have gotten so low that the central bank is starting to show signs of discomfort. The People’s Bank of China has highlighted the need to keep attention on long-term yields, according to a report by central bank-backed media on Tuesday. China’s long-term government bond yields will be within a reasonable range that matches the country’s long-term economic growth expectations, the report said, citing an unidentified PBOC official.

Chinese corporate borrowers have been trying to lock in the country’s record-low borrowing costs. So far this month, a record 317.2 billion yuan ($43.8 billion) of ultralong bonds with a tenor of at least 10 years have been sold, Bloomberg-compiled data show.

As of April 19, 74% of China’s corporate bonds sold by industrial names were yielding below 2.5%. Similarly, 60% of China’s local government financial vehicle bonds were yielding under 2.5%, according to analysts including Dan Jiang at Huaxi Securities.

Among recent issuers, China Three Gorges Corp. sold a 2 billion yuan of 30-year green bond at a coupon of 2.84% this month. China Chengtong Holdings Group Ltd., a state-owned investment company, has issued at least three bonds with tenors of 30 years since March.

“For issuers, they definitely will prefer to issue longer-duration bonds under super-low interest environment to control the costs as they don’t have pressure to repay debt in the short term,” said Yang Hao, a fixed income analyst at Nanjing Securities.

--With assistance from Shuqin Ding.

(Updates with added data, analyst comment)

©2024 Bloomberg L.P.