Aug 8, 2022

China Property Woes Spark Longest Mortgage Debt Halt Since 2015

, Bloomberg News

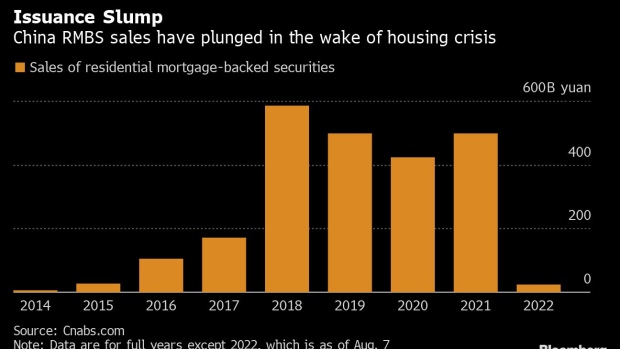

(Bloomberg) -- Chinese banks’ issuance of securities backed by home mortgages has plunged, as the crisis in the nation’s property sector drags down a once-popular and relatively safe investment tool.

Sales of residential mortgage-backed securities have fallen 92% so far this year to 24.5 billion yuan ($3.63 billion), according to data compiled from cnabs.com, a website that tracks asset-backed securities in China. There’s been no RMBS issuance since the end of February, the longest dry spell since 2015.

The slump “reflects weak mortgage origination volume in the first half of 2022 and less-imminent needs for banks to manage their mortgage loan books,” according to Jerry Fang, an analyst at S&P Global Ratings. He said when issuance picks up will depend on mortgage-origination momentum and Beijing’s regulatory stance.

The lack of RMBS sales this year shows the ripple effects of unprecedented property woes that have triggered record defaults by developers and heightened risks for Chinese lenders, especially as owners of unfinished homes have been joining a boycott on mortgage payments. New-home sales plunged 32% in the first half, according to government data, and a proxy for mortgage activity hit its lowest level since at least 2016 despite an effective interest-rate cut for new loans.

Bond-like RMBS had been the most-popular product in recent years for China’s ABS market, with sales driven by state-owned banks. Supported by a surge in mortgages to purchase homes, the amount of principal outstanding reached 1.4 trillion yuan last year, according to cnabs.com. It’s fallen since to 1.2 trillion yuan.

The roughly $300 billion of RMBS sold from 2018 through 2021 made China the world’s second-largest market behind the US, where private-label deals were about $550 billion, Fitch Ratings said in report. While lenders globally package loans and sell them as securities, RMBS issuance isn’t a primary financing channel for China’s lenders.

“The core of RMBS lies in its underlying cash flows or underlying assets,” according to Li Han, a fixed income analyst at Citic Securities Co. Investors are turning more cautious over such products, he said, given unresolved issues including developers’ bond-maturity extensions and other negative news.

©2022 Bloomberg L.P.