Mar 28, 2024

China Property Woes Deepen With Vanke Slump, Country Garden Halt

, Bloomberg News

(Bloomberg) -- One of China’s biggest property firms delayed its earnings report while another posted a record profit decline as the nation’s real estate crisis shows no signs of easing.

Country Garden Holdings Co., once the nation’s top residential builder by sales, made a surprise announcement late Thursday that it will miss a deadline for reporting annual results, saying it needs more information. China Vanke Co., at one time the largest listed developer, said net profit tumbled 46% last year, the biggest drop since its 1991 listing.

The dire statements, along with a jump in bad loans at some banks, underscore how a weak economy and sluggish consumer confidence continue to weigh on home sales in the world’s second-biggest economy. Annual price declines deepened in February for both new and used homes, highlighting the challenge for authorities as they try to salvage the beleaguered market.

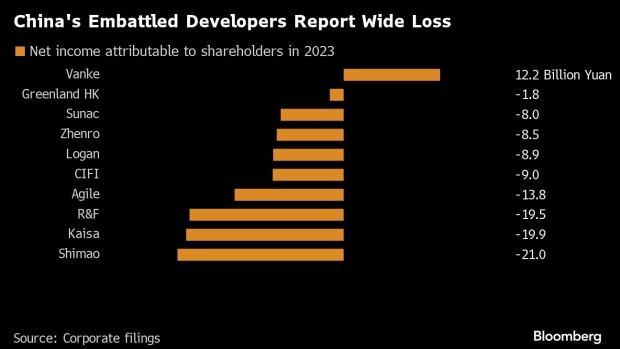

China’s property sector “will likely register the first time net loss since our coverage,” said Raymond Cheng, head of China property research at CGS International Securities HK. “We remain cautious on the sector until developers’ sales improve.”

Read more: China Property Crisis Is Rippling Through Its Biggest Banks

The downturn has spared few firms, be it private or state-backed. Country Garden and Vanke were both hailed as likely survivors just a year ago. Country Garden roiled markets when it defaulted on its dollar debt in October and Vanke is fighting to stave off default through negotiation with insurers on debt.

Country Garden said it expects to delay publishing its 2023 results beyond the March 31 deadline imposed by regulators. The delay will likely result in a suspension of trading on April 2 when the Hong Kong market reopens after Easter, the firm said in a filing.

The postponement signals the developer’s troubles are entering a new chapter after a Hong Kong court received a creditor’s petition to wind up the company following the default on dollar debt. The company also missed a coupon payment on a yuan bond this month for the first time.

The move “suggests new impediments to its restructuring, with any delays to its debt plan likely to fuel concerns of lawsuit risk,” said Bloomberg Intelligence analyst Kristy Hung, in a research note.

Country Garden said it needs time to collect more information so it can “make appropriate accounting estimates and judgments, and reasonably reflect changes in the industry,” according to the filing.

Vanke meanwhile said net income attributable to shareholders shrank to 12.2 billion yuan ($1.69 billion) for 2023. The drop dwarfs a 14% slide expected by analysts surveyed by Bloomberg.

The giant builder said it aims to cut debt by more than 100 billion yuan in the next two years as it “firmly deleverages.” Vanke didn’t propose a cash or stock dividend, skipping a full-year payout for the first time since its 1991 listing in the China market.

Vanke’s stock stumbled as much as 3.8% on Friday to nearly a decade low in Shenzhen. Some of its longer-dated bonds recently traded near 40 cents, approaching deeply distressed levels. Vanke has a $600 million bond due in June trading above 90 cents, indicating less investor concern about repayment in the short-term.

Vanke has enough financing support from banks, the company’s President Zhu Jiusheng said in an online briefing on Friday, adding that it has 26 banking partners.

Together with mid-sized developers, the former giants offer a glimpse into the sector’s worst earnings season ever as the real estate slump enters a fourth year. Among 23 property developers that have released earnings, 14 announced a net loss and six reported shrinking profit, Bloomberg calculations show. Just three saw a mild profit gain.

The protracted property downturn has also eroded the balance sheets of the largest state banks as their bad loans creep up, suggesting a spillover to the financial sector. Beijing tasked state-owned banks with helping pump up the domestic economy as well as supporting debt-laden property developers.

Bank of Communications Co. reported that its property bad loan ratio jumped to 4.99% at the end of last year from 2.8% a year earlier. Bigger rival Industrial & Commercial Bank of China Ltd. saw its bad loans from residential mortgages rise 9.6%. Agricultural Bank of China Ltd. reported a 4.7% increase in soured residential mortgage loans last year.

Read More: China Property Crisis Is Rippling Through Its Biggest Banks

A persistent home sales drought has endangered an increasingly larger group of developers. The residential sales slump deepened in February even as price declines eased slightly on a month-on-month basis. The sales weakness has prompted some global credit raters to downgrade some of the firms into junk territory, including Vanke and Longfor Group Holdings Ltd.

Fitch Ratings on Thursday cut forecasts for the housing market, now expecting a 5%-10% fall in new home sales this year amid weaker home-buying demand. The ratings firm previously estimated a 0%-5% decline.

(Adds Vanke executive’s comment in 13th paragraph. An earlier version of the story corrected the shares.)

©2024 Bloomberg L.P.