Jun 7, 2023

China Haitong Asset Gives Up on Distressed Chinese Debt for US

, Bloomberg News

(Bloomberg) -- Just as China’s credit market is set to receive a policy boost after a dismal start to the year, a unit of one of the country’s biggest brokers is fleeing the asset class to seek returns in the US instead.

Haitong International Securities Group Ltd. has continuously downgraded its dollar-bond exposure to Chinese developers in the past year, and is shifting capital into US sovereign and investment grade notes, said Wang Shengzu, global head of the asset management unit in Hong Kong. The bulk of this year’s gains will probably come from their US holdings, he said.

For the HK$40 billion ($5.1 billion) investment house, the tradeoff is an easy one. The fund has reduced its China real estate exposure to underweight, with no plans to trade or even cherry pick, on expectations a turnaround is too far off. The industry is still in a dire state even after Beijing ramped up support to facilitate funding and boost property demand since last year.

“Our focus is mostly to diversify from China to the rest of world,” Wang, who joined in late 2021 to expand the firm’s fee-based business, said in an interview last week. “You don’t have too much new investment or cash buffer to allocate to Chinese distressed assets given the very high interest rates in US.”

Haitong’s pullback from its own backyard is another indication of the depth of distress still plaguing what was once a lucrative credit market. A Bloomberg index of Chinese high-yield dollar bonds, a sector dominated by developers’ notes, has lost 6.3% so far this year, as a housing market rebound loses momentum and defaults continue to hit sentiment.

That’s on top of more than 20% of annual losses in the previous two years amid the government’s deleveraging campaign, an economic downturn and a record amount of offshore defaults. Even firms selling state-backed debt are struggling.

Bloomberg News reported last week that regulators are considering reducing the down payment in some non-core neighborhoods of major cities, lowering agent commissions on transactions, and further relaxing restrictions for residential purchases.

But Wang doesn’t see a significant loosening of housing market policies or increasing credit quality, and believes “it’s still a very difficult situation,” he said, after the property support measures were reported.

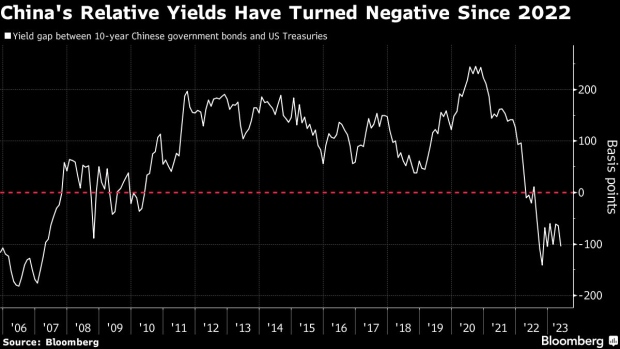

China’s yield disadvantage to its US equivalent has driven overseas funds to cut $169 billion of their holdings over the past five quarters. A swing back to Chinese assets seems unlikely until there’s a clearer roadmap for lower interest rates in the US in the next few months, Wang added.

The asset manager, which has actively rotated out of Asia fixed income to overweight US duration, may add holdings in the five- to 10-year part of the Treasury curve as soon as next week, depending on the messaging from the Federal Reserve, he said. The US central bank is widely expected to hold rates steady in June.

©2023 Bloomberg L.P.