Mar 26, 2023

China Central Government Is Borrowing at Fastest Pace on Record

, Bloomberg News

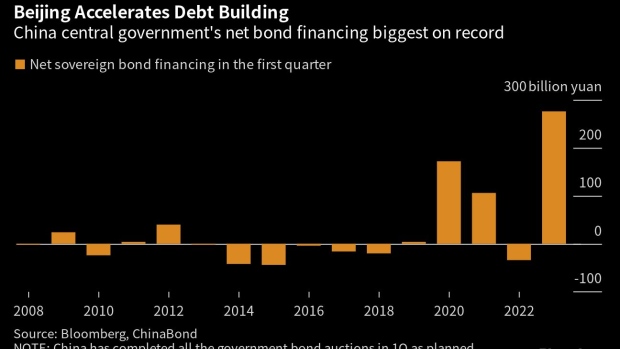

(Bloomberg) -- China’s central government is borrowing at the fastest pace on record to finance more spending and to ease the debt burden in provinces.

The amount of sovereign bonds sold this quarter, excluding those maturing, reached 277 billion yuan ($40 billion), the highest level for the same period since 1997, when the official ChinaBond website started releasing the data, Bloomberg calculations show.

The gross issuance of the notes in the first three months soared 35% from a year earlier to 2.1 trillion yuan.

In China’s 2023 budget — released earlier this month at the National People’s Congress — Beijing outlined plans to increase the central government’s borrowing by roughly 20% from last year to help finance a slightly bigger fiscal deficit and help provinces deal with increasing financial stress. It also plans to expand investment in infrastructure upgrades such as improving the drainage system in cities.

The budget was already in deficit in the first two months of the year for the first time since 2020. Official spending rose to meet debt repayments, health care and other needs, while income continued to shrink as land sales revenue slumped amid a weak property market.

Policymakers have signaled they will rely on a post-Covid rebound in consumption to fuel growth, which they’ve targeted to reach around 5% for this year.

This year’s quota for new special local government bonds — used mainly to finance infrastructure investment — was set at a lower level than the actual issuance in 2022 to contain debt risks. Provinces have been front-loading the sales so that infrastructure projects could start early, thereby helping to spur growth and job creation.

Analysts including those from Goldman Sachs Group Inc. expect fiscal policy to remain accommodative in the first half of the year and normalize gradually in the remainder of 2023.

©2023 Bloomberg L.P.