Mar 28, 2024

Cash at Fed Central Bank Tool Grows Amid Yen Intervention Talk

, Bloomberg News

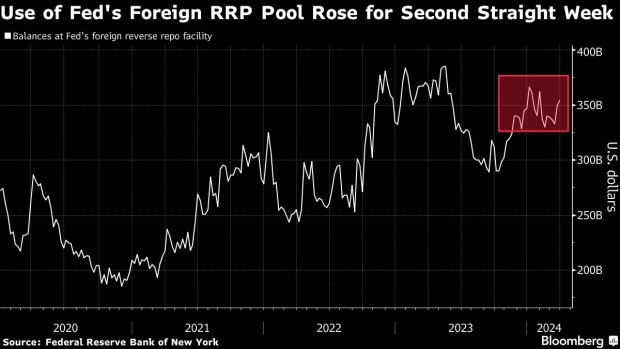

(Bloomberg) -- Usage of a key Federal Reserve facility for foreign central banks rose as Japanese officials this week stepped up warnings they would act to halt the slide in the yen.

Foreign central banks stashed $354 billion at the Fed’s reverse repurchase agreement facility, according to data for the period through March 27, up from $349 billion a week earlier. That’s the most since Jan. 31. At the same time, Fed data shows foreign official holdings of Treasury securities fell by about $5.6 billion in the same period to $2.93 trillion.

As with the domestic reverse repo facility, the foreign RRP is a place where counterparties can park cash overnight with the Fed. Monetary authorities such as the Bank of Japan can keep a big chunk of funds there earning interest instead of in Treasury bills and other securities. And when they need to do something with those dollars, they can just withdraw it from the facility without ruffling markets.

The move in foreign use of the facility comes as the yen hit a 34-year low against the dollar this week, prompting senior officials in Japan to ramp up warnings against the currency’s plunge. Finance Minister Shunichi Suzuki on Wednesday pledged “bold measures against excessive moves” and said the government wouldn’t rule out any options after the yen slid to 151.97 against the dollar.

Before Japan intervened to defend the yen in October 2022, central banks had been boosting the amount of cash they parked at the foreign RRP to what was then a record $333 billion. Balances then declined by the most in five months later that month.

Japan’s foreign currency reserves were worth about $1.15 trillion at the end of February, falling by $11 billion from the previous month, according to the latest data from the Ministry of Finance. About $155.2 billion were parked with the Bank for International Settlements and other foreign central banks, up slightly from $154.9 billion at the end of January.

©2024 Bloomberg L.P.