Jun 10, 2023

BofA Says Stock Bull-Market Means More Gains 92% of the Time

, Bloomberg News

(Bloomberg) -- Bank of America Corp.’s Savita Subramanian is not only calling a formal finale to the bear market that has plagued US stocks, she’s also saying equities have room to keep rallying.

“The bear market is officially over,” the BofA strategist wrote in a note Friday. While the definition of a bull market is “arbitrary,” the S&P 500 has extended gains in the 12 months after crossing the 20% turning point 92% of the time going back to the 1950s, she added.

The US equity benchmark closed 20% above its October low on Thursday following an advance in tech stocks. However, analysts have warned the rally could stall ahead of next week’s Federal Reserve rate decision. The gauge clinched modest gains on Friday.

But key factors beyond the excitement around artificial intelligence that has propelled this year’s gains could give the bull market legs, Subramanian said.

She cites the end of zero-interest-rate policy and return of positive real yields and improving company margins following cost-cutting by companies as just some factors in her case for US stocks to power on.

Subramanian’s view differs from Bank of America peer Michael Hartnett, who earlier on Friday called the S&P 500 bull market’s breakout “bubbly” and reiterated his bearish call on stocks.

While it is not unusual for strategists under the same roof to have diverging views, the contrast is a testament that Wall Street’s most prominent voices are at odds about whether momentum can continue into the second half of the year after stocks gained for two consecutive quarters in spite of doom predictions going into 2023.

As the head of US equity and quantitative strategy, Subramanian focuses chiefly on US stocks, while Hartnett’s views are derived from a global, cross-asset lens.

Signs of continued bearishness are also seen in investor positioning. In the week through June 7, technology funds logged $1.2 billion of outflows, their first in eight weeks, according to BofA, citing EPFR Global data. The move occurred after the group had record inflows last week.

Last week, Subramanian told Bloomberg Radio that flow data was “interpretive” and said her increasingly bullish view comes from revised recession forecasts and discussions with clients who say they have cash on the sidelines waiting to be deployed into stocks.

According to Subramanian, the wall of worry may persist until investors begin to feel the pain of fear of missing out.

“We believe we are back in bull territory, which might be part of what it takes to get investors enthusiastic about equities again,” she said. “If investors feel pain in bonds, via lower returns or negative opportunity costs — likely if real rates rise from here — they should be incented to return to equities, especially equities that benefit from rising real rates.”

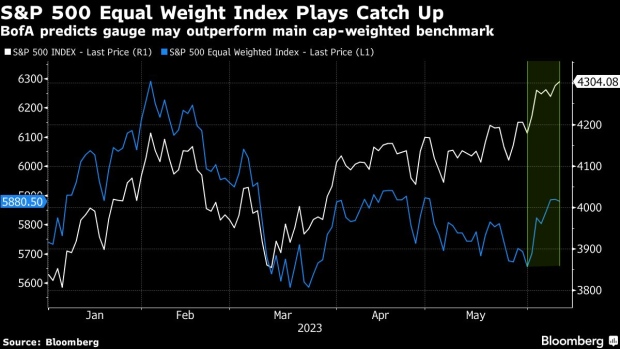

Subramanian also estimates that various signals suggest the equal-weighted version of the S&P 500 could yield double the returns of the main, cap-weighted gauge as the strength seen in technology shares expands into other sectors.

Extreme concentration risks and quantitative tightening indicate valuation mean reversion is likely, and strength may broaden to cyclicals and higher beta stocks, in her view.

©2023 Bloomberg L.P.