Jan 18, 2022

BlackRock CEO Says Nothing ‘Woke’ About Stakeholder Capitalism

, Bloomberg News

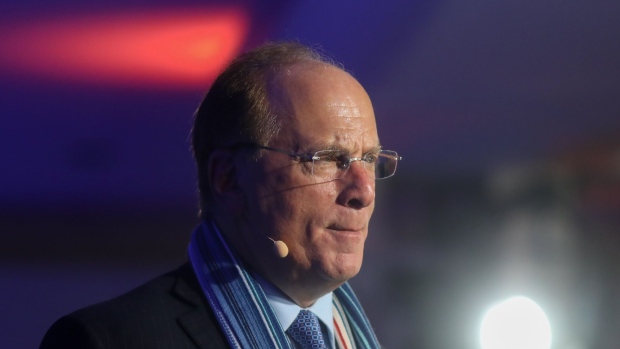

(Bloomberg) -- BlackRock Inc. Chief Executive Officer Larry Fink urged companies to engage with all stakeholders to secure long-term profitability, defending his approach to capitalism as the head of the world’s largest asset manager.

In his annual letter to CEOs, Fink said capitalism is driven by mutually beneficial relationships “between you and the employees, customers, suppliers, and communities your company relies on to prosper.”

“Stakeholder capitalism is not about politics,” Fink said. “It is not a social or ideological agenda. It is not ‘woke.’”

As head of BlackRock, which controls leading stakes in many of the biggest companies, Fink occupies a rare spot in global finance, and has the ear of just about every corporate chieftain. In recent years, he used his letters to argue that companies need to respond to societal problems and especially to climate change, which he has argued will fundamentally reshape markets.

“We focus on sustainability not because we’re environmentalists, but because we are capitalists and fiduciaries to our clients,” he said in the letter published on the firm’s website late Monday in New York.

Left Behind

Fink said companies that fail to embrace the drive for sustainability run the risk of being left behind, as billions of dollars are invested in new technology to fight climate change.

“Every company and every industry will be transformed by the transition to a net zero world. The question is, will you lead, or will you be led?” he wrote. “The next 1,000 unicorns won’t be search engines or social media companies, they’ll be sustainable, scalable innovators – startups that help the world decarbonize.”

He unveiled plans to launch a Center for Stakeholder Capitalism to create a “forum for research, dialogue, and debate.” The center will help to explore the relationships between companies and their stakeholders, he said.

Fink, 69, said business leaders need to work with -- not against -- oil and gas companies to develop new green technologies that cut carbon emissions.

“Divesting from entire sectors – or simply passing carbon-intensive assets from public markets to private markets – will not get the world to net zero,” he said. “And BlackRock does not pursue divestment from oil and gas companies as a policy.”

Asset Surge

As BlackRock has grown, now managing more than $10 trillion of assets, the firm has attracted criticism for either doing too much to pursue environmental, social and governance goals -- or not using its clout enough.

While Fink’s letters have become increasingly outspoken, the firm has previously been criticized for not backing more climate-change resolutions. BlackRock said it voted against 255 directors and 319 companies for climate-related concerns in the 2020-21 proxy-voting season.

Fink said the firm is working to expand an initiative for investors to use technology to cast proxy votes. “We are committed to a future where every investor – even individual investors – can have the option to participate in the proxy voting process if they choose,” he said.

Read more: BlackRock’s Sustainable Investment Funds Surge to $509 Billion

BlackRock’s move to promote sustainable investing has been a major driver of the boom over the past two years, and the company now manages $509 billion in sustainable assets, more than double from a year ago, Fink told analysts during a Jan. 14 earnings conference call.

Fink also has called for overhauling the World Bank and International Monetary Fund to accelerate the transition to clean energy, the creation of so-called bad banks into which fossil-fuel companies would spin off their carbon-heavy assets, and the end of “the largest capital-market arbitrage in our lifetimes,” as hydrocarbon assets move from public to private hands.

©2022 Bloomberg L.P.