Feb 1, 2023

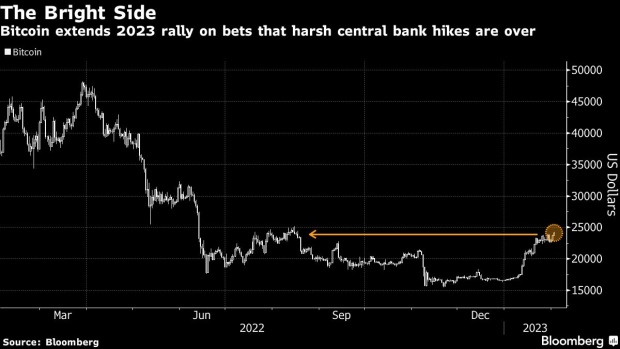

Bitcoin Jumps to Highest Since August in Post-Fed Crypto Rally

, Bloomberg News

(Bloomberg) -- Smaller coins led gains among cryptocurrencies Thursday on the back of investor optimism that central banks in the US and Europe will finally ease their aggressive interest-rate hiking.

Altcoins, including Ether and Cardano, are climbing north of 2% as of 12:47 p.m. in New York Thursday, while Bitcoin pared back its strong advance. Still, the largest token by market value rose as much as 2.4% Thursday before moderating its gains to trade at $23,786. A gauge of the top 100 coins is up 37% so far in 2023.

Investors are “moving out the risk spectrum towards more speculative plays right now,” Matt Maley, chief market strategist at Miller Tabak + Co., said. “Just like they are in stocks.”

Crypto-linked equities are also benefiting from the broad-based enthusiasm. Coinbase Global Inc. is up 19%, while Silvergate Capital Corp., is higher by 36%. Meanwhile, an index of crypto-mining equities is also trading higher by 10.7% Thursday, after registering an unprecedented month when it saw 77% of gains.

Bitcoin has been trading in a tight range these past two weeks, despite it reaching a five-month high on Wednesday. This comes after comments from Federal Reserve Chair Jerome Powell on inflation that signaled less harsh monetary-policy ahead. Still, the price of the token is a far cry from its record of almost $69,000 on November 2021.

“The sideways action after such a big move is constructive,” Frank Cappelleri, founder of CappThesis, said. “BTC’s spike in January was much more pronounced than anything we saw from equities, and simply continuing to consolidate those gains would be bullish.”

It has been a promising start to the year for Bitcoin, which in 2022 fell 64% in its second-worst annual performance on record. The rally has renewed previously-dampened enthusiasm, even as the industry is still grappling with one of its darkest stretches yet amid the fallout of the FTX empire and other crypto firms.

However, the coin’s rally is more muted that other speculative assets. Cathie Wood’s flagship fund ARK Innovation ETF (ticker ARKK), for instance, closed Wednesday above its 200-day moving average for the first time since November 2021. Shares are up 7.7% Thursday.

“Given the moves in ARKK and disruptive stocks and heavily shorted stocks, I’m surprised Bitcoin isn’t up more,” Peter Tchir, head of macro strategy at Academy Securities, said. “I’m even less sure than usual what is holding it back.”

Chart analysts have highlighted that Bitcoin could fizzle at $25,000. In particular, Mark Newton, head of technical strategy at Fundstrat, has flagged $25,200 as an area of potential resistance.

For crypto market prices: CRYP; for top crypto news: TOP CRYPTO.

--With assistance from Sunil Jagtiani, Akshay Chinchalkar and Joanna Ossinger.

©2023 Bloomberg L.P.