Mar 29, 2023

Australia to Release Central Bank Review in April, Chalmers Says

, Bloomberg News

(Bloomberg) -- Australian Treasurer Jim Chalmers will publicly release findings from an independent review of the central bank mid-next month, with some of its recommendations expected to require changes to the Reserve Bank Act.

“My commitment is to receive it tomorrow and to release it with some of our initial views between then and the budget so I’d like to put it out in April,” Chalmers said Thursday. “Some of the recommendations that will be in the Reserve Bank review will require legislative change if we go down that path.”

The report is expected to suggest an overhaul of the RBA’s rate-setting board, fewer policy meetings and for the governor to hold press conferences to explain monetary settings, the Sydney Morning Herald reported Thursday. That follows comments last year from panel member Renée Fry‑McKibbin that the review was looking at whether two boards were required.

In addition to Fry-McKibbin, an economics professor at the Australian National University, the three-member panel includes former Treasury official Gordon de Brouwer and Carolyn Wilkins, a former Bank of Canada senior deputy governor who sits on the Bank of England’s financial policy committee.

While a dual structure is common at a number of central banks, splitting the board would require change to the RBA’s operating legislation, something economists have warned against. The reason is the potential political horse-trading involved could open the door to fringe parties seeking more radical changes to the RBA.

Chalmers signaled he’s reaching out to the opposition Liberal-National coalition to potentially avoid such a scenario.

“We see this as an opportunity for some bipartisanship,” he told Australian Broadcasting Corp. radio on Thursday. “We would come at the recommendations when they’re available in a bipartisan way — this should be beyond politics.”

Chalmers has previously said the review will scrutinize how policy makers communicate rate decisions, an issue that flared again last month following media reports of closed-door meetings between Governor Philip Lowe and interest-rate traders.

The treasurer has also said he will take the review’s findings into account when deciding on the future of Lowe, whose seven-year term expires in September. The governor’s two predecessors received a three-year extension to take their total time at the helm to 10 years.

Chalmers reiterated his position on Lowe’s future on Thursday. He has already moved to replace two RBA board members whose terms expire this year, calling it an “opportunity to refresh.”

The RBA, like many developed-world counterparts, has come in for severe criticism in recent years, particularly later in the pandemic.

This related to a particularly messy exit from a yield target that it was forced to dump under market pressure. Lowe then clung to forward guidance that a rate rise was unlikely before 2024 even as inflation warnings were sounding elsewhere in the world.

He finally abandoned the guidance and since May 2022 the central bank has executed its most aggressive tightening cycle since 1989.

Earlier inquiries at the Federal Reserve and the European Central Bank explored their approaches to inflation, resulting in more scope for them to allow prices to run beyond targets.

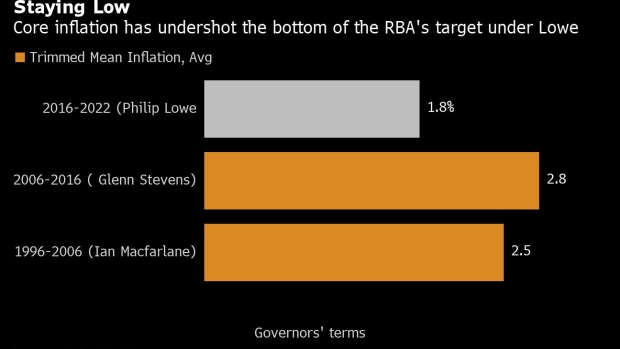

Lowe has previously taken these findings as an endorsement of the RBA’s flexible 2-3% inflation target and this is expected to remain intact.

In New Zealand, a new Labour government in 2018 shifted the central bank to a dual mandate of price stability and employment, and later moved away from the governor having sole rate-decision responsibility to a policy committee. Then, in 2021, it instructed the bank to consider the impact of its rate decisions on the housing market.

The RBA has a triple mandate including the inflation target, full employment and the “economic prosperity and welfare of the Australian people.”

©2023 Bloomberg L.P.