Sep 30, 2022

Airlines Had a ‘Revenge Travel’ Summer. The Stocks Went Nowhere

, Bloomberg News

(Bloomberg) -- Airlines enjoyed a hot summer, as “revenge travel” and steep fare increases gave the companies a boost. But investors have been reluctant to buy in with the market gripped by recession fears, leaving the stocks languishing.

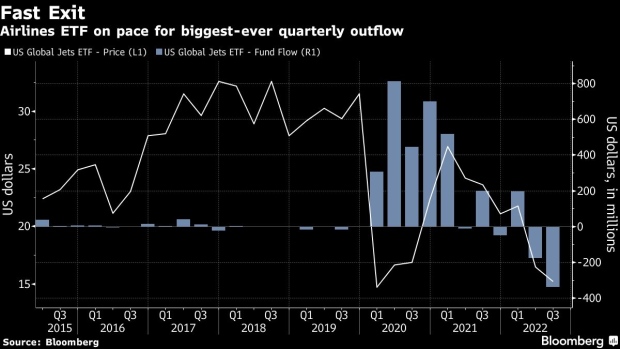

As the third quarter of the year closes, an exchange-traded fund that tracks the sector is on pace for its biggest-ever quarterly outflow, breaking the previous record set in the second quarter. Airline stocks, meanwhile, have given back most of their gains since the market crashed in early 2020, as investors run away from the group with few signs of an economic recovery on the horizon.

The S&P 500 airline index is on track to finish the quarter down 7.4%. By comparison, the S&P 500 hotels, resorts and cruise line index rose roughly 1%, while the broader S&P 500 fell 4.3%. This is an ongoing trend. Since the Covid bottom in March 2020, airline index is up 20% compared with a 58% rise in the S&P 500 Index and a 60% increase in the hotels index.

Among the hardest hit stocks in the group are Southwest Airlines Co., which declined 14% in the third quarter, and JetBlue Airways Corp., which sank 20% amid a takeover battle for Frontier Airlines and an antitrust trial. Meanwhile, the $1.9 billion US Global Jets ETF (ticker JETS) had a third-quarter outflow of about $339 million as of Sept. 29, according to Bloomberg data. In the second quarter, that figure was about $178 million.

“Airlines are in a perfect storm,” said Catherine Faddis, chief investment officer of Grace Capital. The carriers are heavily indebted as interest rates and the cost of borrowing is increasing, and with inflation biting into consumer’s disposable income. “You would have to be a very brave contrarian to want to catch this falling knife,” she said.

The problems facing the industry are clear. Since Covid-19 hit, people are simply flying less. A seven-day average of the number of air passengers going through security checkpoints is currently hovering at around 7% below the pre-pandemic levels in 2019, according to Transportation Security Administration (TSA) data.

Carriers are also grappling with severe staff shortages, widespread operational troubles, high fuel costs and regulatory risks, with President Joe Biden planning new laws to force airlines to be more transparent about charges.

Business travel, which carries the largest profit margin for airlines, has continued to lag as well. And while the demand for international travel was recovering, it has slowed in the fall.

The strong summer season is expected to help airlines’ report sales of about $54 billion in the third quarter, higher than the $49 billion recorded in the comparable period in 2019. Still, profit for the group is estimated to be around $2.7 billion, compared to $4.6 billion in the third quarter of 2019, reflecting the eroding margins amid the myriad pressures.

Analysts’ 2022 earnings estimates for the group paint an even grimmer picture. Average profit expectations for US airlines are down about 85% since the start of the year, and they’re down more than 35% for 2023, according to data compiled by Bloomberg Intelligence.

“Robust airlines results in third quarter, supported by strong summer travel demand, could be overshadowed by fears of softening demand through winter, while rising operating costs keep margins below 2019 levels,” Bloomberg Intelligence analyst Francois Duflot said in an interview.

To be sure, airline stock prices reflect all of those worries. But even with those steep discounts, investors remain wary.

“Valuations are only cheap if the airlines remain profitable,” said Cowen analyst Helane Becker. “Investors are concerned about inflation and recession, which is why the stocks are trading back at March 2020 levels.”

(Updates index performance in third paragraph)

©2022 Bloomberg L.P.