Feb 6, 2023

AI Frenzy Leaves Traders Flush, Long-Term Investors in the Hole

, Bloomberg News

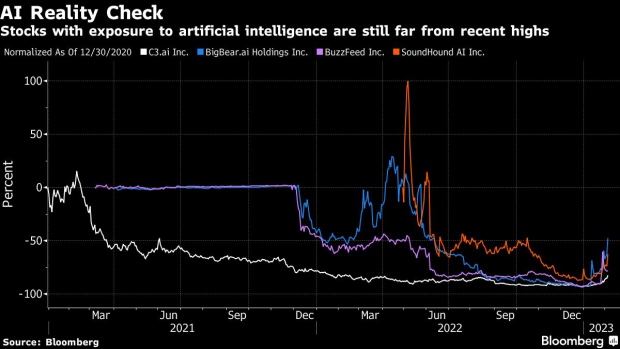

(Bloomberg) -- The frenzy of triple-digit rallies for companies tied to artificial intelligence has been a boon for traders jumping on the bandwagon, but investors who bought in early are still waiting to recoup their money.

A nearly 150% surge for C3.ai Inc. shares to start the year has been cheered across social media. However, there’s little to celebrate for those who bought into its initial public offering over two years ago. The stock remains down 86% from an intraday peak in December 2020 and needs to rally another 60% from Monday’s level just to climb above its IPO price.

AI companies are the latest market craze as speculators dive into shares as they soar. Among the stocks to surge in 2023 are a bevy of battered de-SPACs — firms that went public via special-purpose acquisition companies — and other under-the-radar companies with little immediate profit potential. But even with the strong rallies, most of these companies remain underwater from their IPO prices.

De-SPAC BigBear.ai Holdings Inc. brought its year-to-date gain to more than 700%, while SoundHound AI Inc. has surged 90% to $3.37 as of 1:24 p.m. in New York Monday. Despite the rallies, both are well below the $10 a share mark at which SPACs typically go public.

Quantum-computing stocks added to gains amid the frenzy on Monday, as investors speculated on which areas could benefit from the boom in AI technology. Arqit Quantum Inc., Rigetti Computing Inc., and D-Wave Quantum Inc. are all de-SPACs that have rallied 20% each in the past week. However, they’re all still trading below $4 a share.

AI stocks aren’t the only investments to gain as the broader market trades in the red Monday. Speculative meme stocks including Express Inc. and Bed Bath & Beyond Inc. are rallying, while the world’s largest cryptocurrency based on market value, Bitcoin, is back above $23,000.

©2023 Bloomberg L.P.