Nov 30, 2022

Wall Street Analysts Haven’t Been This Bullish on Tesla Since 2015

, Bloomberg News

(Bloomberg) -- Tesla Inc. is getting a strong show of faith from a group that Chief Executive Officer Elon Musk once blasted for doubting the company’s prospects: Wall Street analysts.

The electric-carmaker’s shares closed up 7.7% Wednesday, after Federal Reserve Chair Jerome Powell signaled a slowdown in the pace of tightening as early as December, triggering a market-wide rally. Despite the strength, Tesla’s stock recorded its biggest monthly drop since April, capping a rout that’s pushed it down some 37% since late September on concerns about a recession, rising interest rates and the ripple effects of Musk’s takeover of Twitter Inc.

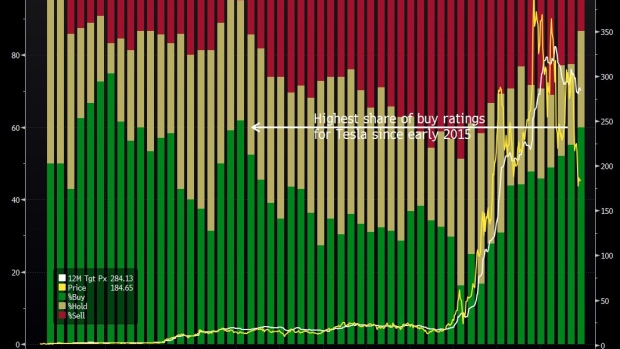

But the scale of the slide has turned securities analysts increasingly bullish, wagering that the selloff has run too far. More than 60% are now recommending that investors buy Tesla stock, the highest share since early 2015, according to data compiled by Bloomberg. And such ratings have been ratcheted up steadily this year, with at least two analysts upgrading the stock this month and several reiterating their bullish stance.

“The Tesla bulls I know are loading up at these levels,” said Catherine Faddis, senior portfolio manager at Fernwood Investment Management.

After hitting an all-time high in early November 2021, Tesla’s share price has been dragged down by interest-rate hikes that have hammered growth-stock valuations and by problems that have dogged the global economy since the pandemic.

Tesla has been contending with a supply-chain crisis and soaring costs of raw materials that are affecting the entire auto industry. It has also seen multiple production disruptions at its key factory in China, where the government has taken a hard line toward containing the pandemic. More recently, the rising fears about a recession next year fueled concern that demand for its relatively expensive cars may also take a hit.

Musk’s Twitter deal has also been a major drag on Tesla’s share price. That’s because of the risk that he could sell stock to inject more cash into the money-losing social-media site and that turning around Twitter will take his focus away from the EV maker.

Some analysts remain skeptical that the worst is over, with its stock still commanding a higher price-to-earnings ratio than 90% of the stocks in the S&P 500. Some 27% of the analysts tracked by Bloomberg still rate Tesla a hold, while 13% advise selling the stock.

“Tesla’s stock price remains high on almost every valuation metric compared with traditional automakers due to its unique growth profile,” Bernstein analyst Toni Sacconaghi, who rates Tesla the equivalent of a sell, wrote in a note on Tuesday. He added that broader market pressures amid higher rates and slower consumer spending, could “likely impact higher valuation stocks such as Tesla disproportionately.”

But the bullish sentiment is being stoked by the steep drop in its stock price and expectations that its business will boom over the long-term as it extends its competitive edge in the electric-vehicle market.

The shares have cheapened so much that Tesla has since retraced several milestones it broke through during the stratospheric surge of 2020 and 2021, including losing its position as the fifth-most valuable company in the S&P 500 Index to Berkshire Hathaway Inc. and its $1 trillion market capitalization.

Yet retail investors, among whom Tesla enjoys ardent support, are continuing to pile into the stock, according to data from Vanda Research. Tesla was second only to the SPDR S&P 500 ETF in a list of the most bought securities this year, in terms of number of days at the top spot, Vanda said.

Those bulls have some positive business fundamentals to point to. As the leading EV maker, the company is set to benefit from US President Joe Biden’s Inflation Reduction Act, which provides a tax credit for buyers of such vehicles. The widely awaited Cybertruck pickup is expected to get into production in the middle of next year, and the company is holding a delivery event on Thursday for its Semi trucks.

Citigroup Inc. analyst Itay Michaeli last week upgraded Tesla shares, saying the valuation was more balanced after the selloff and the company’s strong competitive edge in the EV market will help it weather a downturn. Morgan Stanley’s Adam Jonas struck a similar chord, saying Tesla is the only EV maker covered by the bank that generates a profit on the sale of its cars.

“In a slowing economic environment, we believe Tesla’s ‘gap to competition’ can potentially widen, particularly as EV prices pivot from inflationary to deflationary,” Jonas said.

(Updates stock move in second paragraph.)

©2022 Bloomberg L.P.