Jun 27, 2022

Venture Funding Set to Hit Lowest Level Since 2020

, Bloomberg News

(Bloomberg) -- Venture capital-backed startups raised far fewer rounds of funding during the past three months than they did during the more ebullient days of late last year and early this year, according to new data from analytics firm CB Insights.

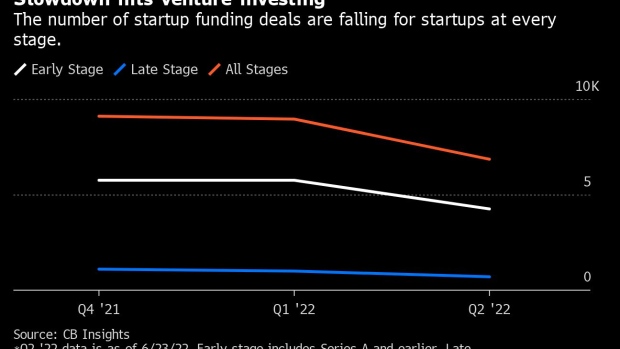

Deal activity across the globe dropped 23% between the first quarter and second quarter of this year, the firm found, using data for the second quarter through June 23. That’s a stark contrast to the previous quarter, where the deal count dropped only 1.4%—and an indication that the roiling of the crypto and public markets are affecting private companies.

Investors are not just writing fewer checks but also smaller ones. The total funding amount going to startups for the current quarter to date dropped 27% compared to the first quarter. Those numbers are likely to change before the second quarter is officially over in a week, but the drop appears to be more severe than the 19% CB Insights had predicted just a month ago. Late-stage companies are getting squeezed particularly hard: Funding in Series D rounds or beyond dropped 43%.

In May, venture firms such as Sequoia Capital and Lightspeed Venture Partners warned their portfolio companies that they should prepare for a significant throttling of the money that, for a decade, had flowed at increasing volumes. Sequoia’s investors argued that a drawn-out recession lies ahead and called it a “crucible moment”—a prediction reminiscent to the firm’s “RIP Good Times” memo in 2008. Sequoia told founders to “do the cut exercise,” meaning to look at their spending and find places where they could lower expenses on short notice if needed.

The tech investing climate has changed radically in recent months. After a short period of uncertainty at the beginning of the Covid-19 pandemic, startup investing activity shot upward, fueled by a newly remote world that needed to connect digitally rather than in person. That frenzy led to unprecedented levels of money flowing into startups in 2021. By early 2022, so many companies were raising at valuations of $1 billion or more that a new “unicorn” company was minted about twice a day. Over the past three months, however, the number of deals and the total funding raised have dropped to their lowest levels since late 2020.

©2022 Bloomberg L.P.