Mar 30, 2023

US Investment Firm Bets £300 Million on Red-Hot UK Rental Market

, Bloomberg News

(Bloomberg) -- An American private equity firm has agreed to finance a roughly £300 million ($370 million) housing development in Birmingham, in the biggest ever UK build-to-rent funding deal outside of London.

Harrison Street Real Estate Capital — a Chicago-based firm with $55 billion in assets under management — will team up with Apache Capital and NFU Mutual to finance 722 apartments overlooking Birmingham’s trendy Jewellery Quarter district. The 39-story Great Charles Street development — which will be developed on a former car park by Moda Living — is the latest bet on Britain’s red-hot rental market.

“This transaction underscores our continued efforts to invest in premium build-to-rent assets,” said Paul Bashir, chief executive officer of Harrison Street’s European business. “The Birmingham market is backed by strong demographics, with the greatest concentration of businesses outside of London.”

Supply in Britain’s £56 billion build-to-rent market has more than tripled in the last five years, according to a Knight Frank report published in December. There is a pipeline of more than 151,000 build-to-rent homes outside of London, compared with 91,272 in the capital, British Property Federation data show, underscoring the sector’s growing prominence in regional UK cities.

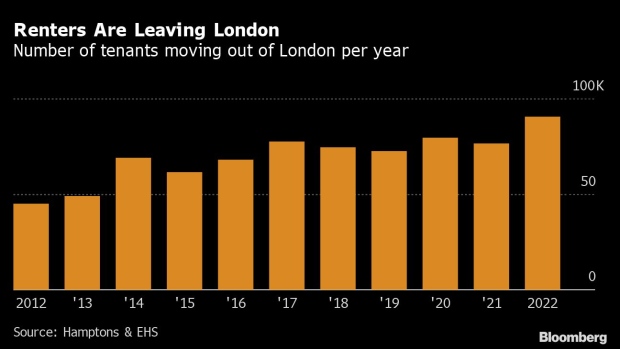

The Birmingham deal comes as London’s renters leave the city in droves, as pricey monthly payments squeeze budgets to the limit. The average monthly rent paid for a newly let home in Greater London rose 9.1% year-on-year to £2,141 in January, according to broker Hamptons International, outpacing the 8% growth in the rest of Great Britain during the same period.

Harrison Street’s financing beats the former record for the biggest build-to-rent single-asset funding deal outside of London, according to Knight Frank, previously held by a £215 million plan in Edinburgh. It’s one of only four single-asset, build-to-rent funding transactions to ever exceed £200 million outside of the capital.

The Great Charles Street development promises BBQ areas, gym with personal training, private dining, cinema and meeting rooms.

“This is a landmark deal for the UK’s build-to-rent market,” said Will Jordan, partner at Knight Frank, the broker that advised on the deal. It’s “a huge show of confidence for a market that continues to go from strength to strength despite challenging economic headwinds,” he added.

Still, transactions are also happening in London. Construction firm Galliford announced on Wednesday that it received a £75 million contract to build hundreds of build-to-rent homes in north London, after securing financing from lenders including Barclays Bank Plc.

“Buyers are being forced into the rental market due to a decrease in the supply of homes available to buy and worsening affordability,” said Randeesh Sandhu, chief executive officer of property lender Precede Capital Partners. There is a “pressing need to keep delivering a steady supply of new homes for sale and rent,” he added.

(Updates with features in seventh paragraph. An earlier version corrected the name of a partner in second paragraph.)

©2023 Bloomberg L.P.