Feb 5, 2023

UK Mortgages Set for Slowest Year Since 2011 as House Prices Dip

, Bloomberg News

(Bloomberg) -- Mortgage lending is expected to grow at its slowest rate in more than a decade amid Britain’s rising interest rates and falling house prices, according to a report published Monday.

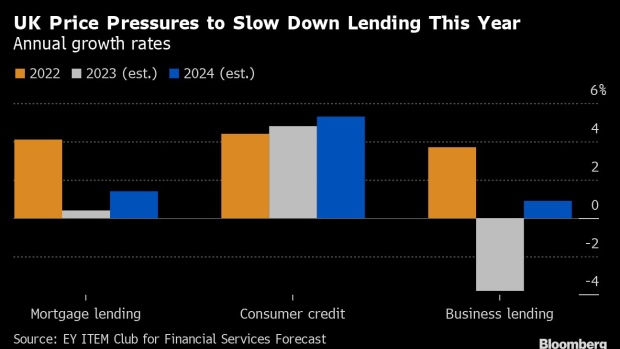

Demand for mortgages is set to increase just 0.4% this year, down from 4.1% in 2022, research from accounting firm EY said. That’s due to a toxic mix of rising borrowing costs, inflation-squeezed incomes and house prices that are falling but still very high by historical standards.

The last time lending for home-buyers was this slow was 2011 in the aftermath of the financial crisis. Growth in mortgage lending could pick up in 2024, reaching 1.4%, EY said. Still, that depends on easing inflation and the Bank of England cutting borrowing costs at the end of this year.

Read More: Londoners Are Selling Homes on WhatsApp as Off-Market Sales Boom

“The series of economic shocks in recent years and the current cost of living pressures are having a significant impact on both households and businesses,” said Anna Anthony, UK financial services managing partner at EY.

“Those most affected are the vulnerable in society and small businesses which may have limited financial cushions of support to fall back on.”

Bank-to-business lending is also facing a reversal of fortunes. EY predicts higher debt servicing costs, lower earnings and supply chain snarls will see it drop 3.8% this year, after a 3.7% rise in 2022. Although business lending is expected to return to growth in 2024, it’s estimated the increase will be less than 1%.

The estimates come after the Bank of England said the UK economy is already in a recession. The twin challenges of low growth and high inflation mean the country will struggle to expand even after the downturn is over without risking price rises.

In this climate, banks should brace for low or even negative lending growth rates, as well as rising defaults, according to Anthony. Still, default rates are predicted to stay considerably below financial crisis levels.

Retail Spending

Consumer credit is set to grow 4.8% this year and increase even further in 2024, according to EY. The sharpest rise in consumer borrowing in over 18 years has benefited UK retailers, as Britons turn to buy-now-pay-later and other financing options for everything from milk to TVs.

Hopes of an economic recovery in the second half of this year are helping keep credit demand afloat, EY said, even as the cost-of-living crisis deters customers from spending on big ticket items.

©2023 Bloomberg L.P.