Dec 1, 2022

UK House Prices Fall Most Since Start of Covid, Nationwide Says

, Bloomberg News

(Bloomberg) -- UK house prices are falling more sharply than expected after a jump in borrowing costs quelled demand, Nationwide Building Society said.

The mortgage lender said home prices fell 1.4% in November, the fastest drop since June 2020. Excluding the pandemic, prices haven’t fallen this sharply since the global financial crisis more than a decade ago. Economists had expected a 0.4% drop.

The decline could be the start of a more protracted downturn, reflecting Britain’s lurch into a recession and spiraling inflation that’s caused the tightest cost-of-living squeeze in memory. The Bank of England has boosted its benchmark lending rate to 3% from near zero a year ago, meaning those who remortgage in the next year may see their payments double.

“Interest rates for new mortgages remain elevated and the market has lost a significant degree of momentum,” Robert Gardner, Nationwide’s chief economist, said in a statement Thursday. “Housing affordability for potential buyers and home movers has become much more stretched at a time when household finances are already under pressure from high inflation.”

What Bloomberg Economics Says ...

The UK housing market is undergoing a correction. The biggest monthly fall in the Nationwide house price index since the early days of the pandemic follows on from an already substantial drop in October. We see home values falling by a bit less than 10% in the coming year as higher mortgage rates bite and the squeeze on the cost of living intensifies.

--Niraj Shah, Bloomberg Economics. Click for the REACT.

The cost of a five-year fixed-rate mortgage fell below 6% for the first time in almost seven weeks last month, providing a glimmer of hope for Britons affected by the UK’s home loans crunch.

Still, the two-year fixed-rate deal remains above 6%. With rates at 6%, a two-year mortgage will cost about £10,000 more during the fixed period than the same product issued last December, when rates were about 2.34%, according to Moneyfacts data. That’s based on a mortgage of £200,000 borrowed for 25 years.

“Although mortgage rates have retreated from the highs seen just after the mini-Budget, they’re still elevated compared to early-mid September and could head higher again given the prospect of more rate increases,” said Martin Beck, chief economic adviser to the EY ITEM Club, which uses the Treasury’s forecasting model. It expects house prices to drop 10% in 2023.

The average value of a home fell to £263,788 ($319,120), which is 4.4% higher than a year ago. The annual pace of housing price inflation slowed from as much as 14.3% in March.

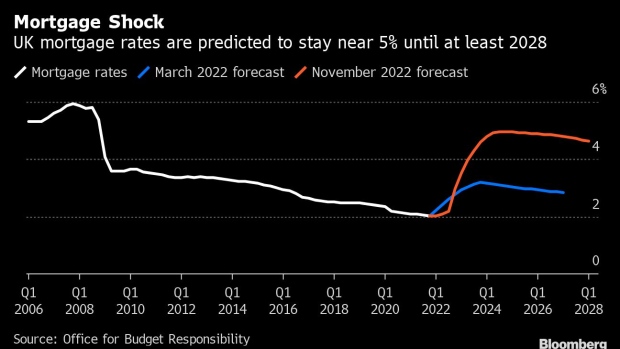

Home-buyers may have to pay an average of 5% to take out a mortgage through 2028, the government’s Office for Budget Responsibility has estimated. It’s anticipating a possible 9% drop in house prices over the next two years.

For now, Nationwide said that households were largely protected from rising borrowing costs for the moment, given that 85% of UK mortgage holders were on fixed rates mortgages.

Monthly payments are set to double for many of the 1.8 million UK households due to refinance in 2023, according to a Bloomberg Intelligence report.

Housing in the northern regions of the UK, Scotland and Wales has become less affordable against average household incomes compared to before the pandemic. Meanwhile London -- the least affordable both before and since Covid -- has remained largely the same in terms of affordability for buyers.

High borrowing costs are translating into weaker demand. Bank of England data published earlier this week showed mortgage approvals -- an indicator for future borrowing -- fell to the lowest levels since early in the pandemic.

Home sellers are already cutting asking prices, according to property search websites. Zoopla reported that one-in-10 homes for sale have lowered prices by 5% or more since September. Earlier this month, Rightmove said that sellers were slashing prices at the fastest rate since August.

--With assistance from Damian Shepherd.

(Updates with context in third paragraph and mortgage details from the fifth. Adds chart.)

©2022 Bloomberg L.P.