Sep 21, 2022

U.S. stocks roiled by crazy gyrations after hawkish Fed

, Bloomberg News

BNN Bloomberg's closing bell update: September 21, 2022

Stocks saw some wild swings, with traders overwhelmed by the many headlines that followed the Federal Reserve decision and ended up signaling at least one thing: policy will remain aggressively tight -- making the odds of a soft landing look increasingly elusive.

The S&P 500 ended near session lows, pushing its slide from a January record to more than 20 per cent. The gauge whipsawed in the aftermath of the Fed announcement, climbing as much as 1.3 per cent at one point. Treasury two-year yields topped 4 per cent, piercing that mark for the first time since 2007. The dollar rallied.

Jerome Powell vowed officials would crush inflation after they raised interest rates by 75 basis points for a third straight time and signaled even more aggressive hikes ahead than investors had expected. Powell said his main message was that officials were “strongly resolved” to bring inflation down to the Fed’s 2 per cent goal and added that “we will keep at it until the job is done.” The phrase invoked the title of former Fed chief Paul Volcker’s memoir “Keeping at It.”

“Jerome Powell almost channeled his inner Paul Volcker today, talking about the forceful and rapid steps the Fed has taken, and is likely to continue taking, as it attempts to stamp out painful inflation pressures and ward off an even worse scenario later down the line,” said Seema Shah, chief global strategist at Principal Global Investors. “With the new rate projections, the Fed is engineering a hard landing -- a soft landing is almost out of the question.”

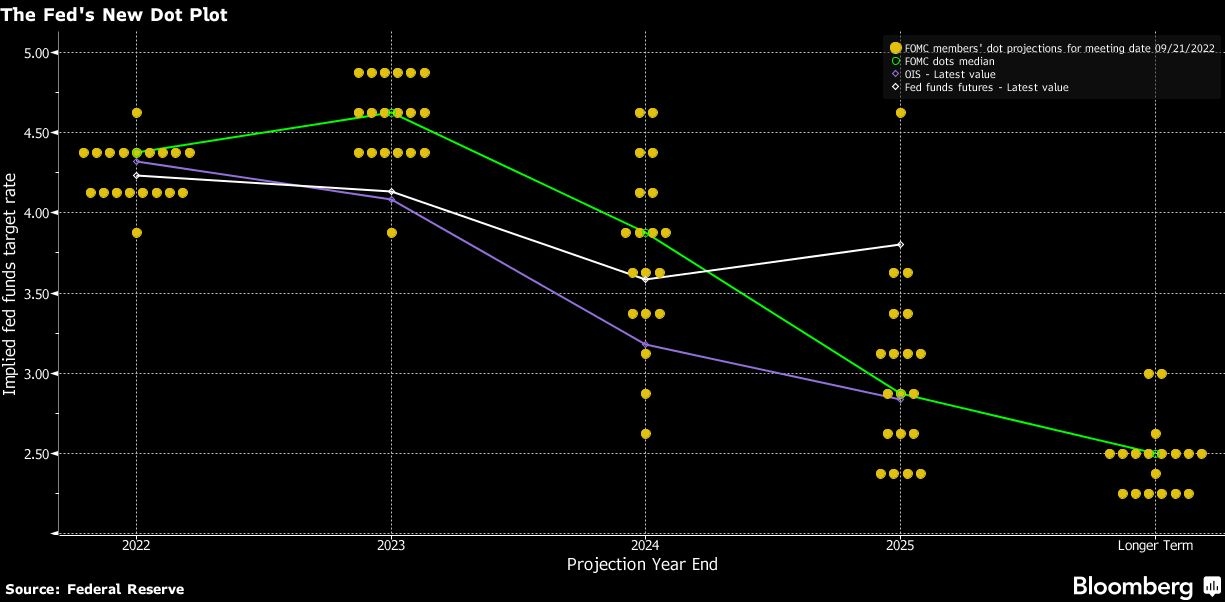

Officials forecast that rates would reach 4.4 per cent by the end of this year and 4.6 per cent in 2023, a more hawkish shift in their so-called dot plot than expected. That implies a fourth-straight 75-basis-point hike could be on the table for the next gathering in November -- about a week before the US midterm elections.

More Comments:

- “We do think that markets, and consequently the economy, will become ‘Fed up’ with too much tightening, if growth (and employment) are tangibly slowing alongside of these tighter policy moves,” said Rick Rieder, BlackRock’s chief investment officer of global fixed income.

- “Today’s Fed action, combined with ongoing rollercoaster-like market volatility, underscore the unease of investors amid the magnified economic and market uncertainties driven by high inflation, corporate earnings warnings, geopolitical concerns and other factors weighing heavily on both Wall Street and Main Street,” said Greg Bassuk, chief executive officer at AXS Investments.

- “They have a brief window to act aggressively, and they seem eager to use it,” said Jan Szilagyi, co-founder of Toggle AI, an investment research firm.

- “The first set of Fed releases from the September meeting are unambiguously hawkish,” said Krishna Guha at Evercore. “The macro projections signal increased risk of a harder landing.”

- “The Fed was late to recognize inflation, late to start raising interest rates, and late to start unwinding bond purchases,” said Greg McBride, chief financial analyst at Bankrate. “They’ve been playing catch-up ever since. And they’re not done yet.”

Key events this week:

- Bank of Japan monetary policy decision, Thursday

- The Bank of England interest rate decision, Thursday

- US Conference Board leading index, initial jobless claims, Thursday

Here are some of the main moves in markets:

Stocks

- The S&P 500 fell 1.7 per cent as of 4 p.m. New York time

- The Nasdaq 100 fell 1.8 per cent

- The Dow Jones Industrial Average fell 1.7 per cent

- The MSCI World index fell 1.5 per cent

Currencies

- The Bloomberg Dollar Spot Index rose 0.7 per cent

- The euro fell 1.2 per cent to US$0.9847

- The British pound fell 0.9 per cent to US$1.1281

- The Japanese yen was little changed at 143.88 per dollar

Bonds

- The yield on 10-year Treasuries declined six basis points to 3.51 per cent

- Germany’s 10-year yield declined three basis points to 1.89 per cent

- Britain’s 10-year yield advanced two basis points to 3.31 per cent

Commodities

- West Texas Intermediate crude fell 0.7 per cent to US$83.34 a barrel

- Gold futures rose 0.6 per cent to US$1,681.40 an ounce