Oct 22, 2021

Treasury Yields, Breakevens Reprice as Powell Nods at Inflation

, Bloomberg News

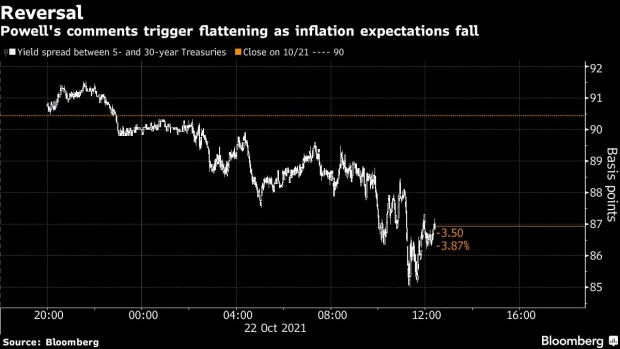

(Bloomberg) -- U.S. Treasury yields beyond the two-year declined and market-implied inflation expectations retreated from multi-year highs after Federal Reserve Chair Jerome Powell said the central bank is monitoring inflation carefully and will adapt accordingly.

The two-year yield, more closely tied to Fed policy, briefly rose to 0.488%, the highest level since March 2020, pricing in higher odds the central bank will raise rates next year. As longer-maturity yields declined, the gap between the 5- and 30-year collapsed to about 85 basis points, within a basis point of its lowest since April 2020.

Treasuries outperformed inflation-protected securities after Powell’s comments, causing market-based inflation expectations to come off the boil. Earlier Friday, expected inflation over the coming five years topped 3% for the first time on record. It retreated to 2.88% following Powell’s comments.

Powell also said it was time for the Fed to taper asset purchases but too soon to raise rates. He spoke Friday during a panel discussion at a virtual event hosted by the South African Reserve Bank.

©2021 Bloomberg L.P.