Mar 28, 2023

Top Financial Watchdog in Korea Vows to Stop Wider Loan Failures

, Bloomberg News

(Bloomberg) -- The slump in South Korea’s property market may lead to defaults on project-financing loans, but policymakers have put in place measures to cope following an unexpected credit crunch last year, according to the nation’s financial watchdog chief.

The authorities have assessed some 5,000 real estate projects relying on these loans, and are ready to act swiftly after getting “vaccinated” by a crisis triggered by a theme park developer’s default last year, Lee Bokhyun, governor of the Financial Supervisory Service, said in his first media interview since taking the helm in June last year.

“Some of them might fail eventually, but what we’re trying to do is spread out all those effects throughout a timeline gradually,” he said in a Bloomberg TV interview in Seoul. “If any serious financial institutions or big construction company falls with the burden of increased interest payments or collapse of collecting their incomes from counterparts, that might put a systematic problem on our economy and financial markets.”

Lee’s comments come as rising interest rates and slowing economic growth everywhere heap pressure on banks and developers struggling to adjust after years of loose monetary policies. Korea’s $1.3 trillion credit market was rocked last year by its worst meltdown since the global financial crisis when the developer for the Legoland Korea theme park unexpectedly defaulted, spurring policymakers and banks to inject liquidity and buy debt to contain a rout.

The former prosecutor also said Korea is unlikely to experience the likes of Silicon Valley Bank’s collapse as its lenders have sufficient buffers and limited securities exposure. With banks’ deposits mostly consisting of retail accounts in small amounts, the risk of a massive bank run is also low, he added.

READ: Korea Can Consider Ending Short Sale Ban in 2023, Watchdog Says

Lee, 50, was appointed to head the nation’s financial watchdog after leading an investigation and eventual conviction of Samsung Electronics Co.’s leader Jay Y. Lee on corruption charges.

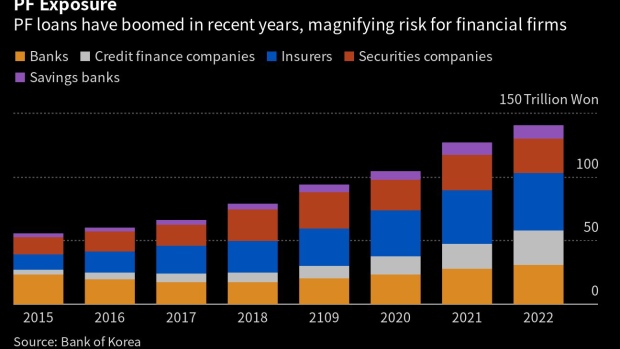

Korean banks and other financial firms were exposed to about 140 trillion won ($108 billion) of project-financing loans as of September, according to the Bank of Korea. The debt, usually required to be repaid before developers complete construction, was behind the sudden turmoil of last year. With home sales slowing, the terms of such loans threaten to hurt developers without sufficient cash reserves.

So long as policymakers are able to contain the fallouts from any defaults, the nation’s macroeconomic stability won’t be severely damaged, though a market slump can still hurt consumption, Lee said.

CoCo Bonds

Korean officials said this week that market stabilization measures enacted during the credit crunch will be kept in force for longer. Spreads on benchmark corporate notes have widened again after months of stabilizing, and vulnerable sectors such as project-financing asset-backed securities haven’t fully recovered.

Lee also ruled out the risk of a wipeout of additional tier 1 bonds as seen in the shotgun deal to rescue Credit Suisse Group AG.

Korean banks have some 32 trillion won of outstanding AT1 bonds, which isn’t a large amount considering the size of their assets, according to Lee.

“A lot of the reasons that terrified investors in Europe is that their AT1 might be wiped out. In Korea, CoCo bonds aren’t designed that way,” Lee said. “The trigger point is more complicated and way more harder to achieve.”

Responsible Banks

Lee called on the nation’s lenders, who have been booking profits and paying out big bonuses thanks to higher borrowing costs, to “share the burden during this era of unprecedented high interest rate.”

His comments come as President Yoon Suk Yeol criticized banks for having what he called a “money feast.” More than a year of monetary tightening has pushed the BOK’s benchmark rate to 3.5% from 0.5%, with major banks’ mortgage rates easily topping 4%.

Bankers should acknowledge that “they are getting a big chunk of money out of the system so they may alleviate the interest burden on households and SMEs,” he said, warning that a significant number of small firms may fail within six months to a year unless action is taken.

--With assistance from Sangmi Cha, Jaehyun Eom, Jeong-Ho Lee, Sabrina Mao, Andy Hung, Youkyung Lee, Heba Moussa von Thun, Rika Yoshida, Shinhye Kang and Hooyeon Kim.

(Updates with comment on lenders’ deposits in fifth paragraph.)

©2023 Bloomberg L.P.