Jun 7, 2023

TikTok Seeks $20 Billion E-Commerce Business Despite US Setback

, Bloomberg News

(Bloomberg) -- ByteDance Ltd.’s TikTok aims to more than quadruple the size of its global e-commerce business to as much as $20 billion in merchandise sales this year, banking on rapid growth in Southeast Asia, according to people familiar with the matter.

That would be a speedy increase from last year’s $4.4 billion in gross merchandise value, which represents the total worth of goods sold through its TikTok Shop offering, said the people, who asked not be identified discussing internal data. TikTok is betting on markets such as Indonesia, where influencers sell products from denim jeans to lipstick by showing them off in live-streamed videos.

TikTok is working to expand sales in the US and Europe too, though those markets make up a small portion of the $20 billion goal, the people said. The world’s most valuable startup is trying to grab a bigger slice of a $17 trillion online commerce arena as its main revenue driver — its advertising business — slows during an economic downturn.

TikTok’s efforts to expand its e-commerce operation in the US now may seem counterintuitive given threats by American politicians to ban the app altogether over national security concerns. Yet forming profitable ties with US merchants and brands could help TikTok gain allies just as it begins to fight back against critics in Washington and in the courts.

The Chinese-owned company is intent on exporting its commerce model to the US and its 150 million users there. It has proposed a range of measures to address national security concerns in the US, including cordoning off American users’ data and allowing partners like Oracle Corp. to review its technology. Still, the state of Montana imposed a prohibition on the app’s download starting in 2024 and lawmakers have proposed similar bills for a nationwide ban.

A TikTok spokesperson declined to comment on the company’s financials.

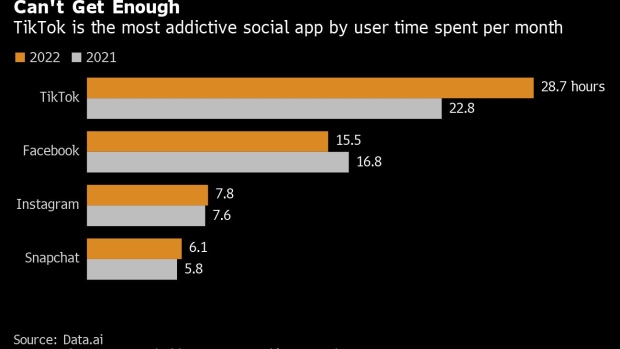

ByteDance, founded more than a decade ago by Zhang Yiming and Liang Rubo, grew into an internet leader worth more than $200 billion thanks to the virality of short-video platforms TikTok and Douyin. Though live shopping hasn’t caught on in the US and Europe despite attempts by Instagram and others, TikTok is basing its projections on the success its Chinese cousin Douyin has enjoyed at home.

TikTok Shop lets users buy items while scrolling through an endless feed of short videos and livestreams within its main social media application, hoping consumers use it as an alternative to Amazon.com Inc. or Sea Ltd.’s Shopee. That format — which melds entertainment with impulse buying — has already helped Douyin snatch a big portion of Chinese consumer spending from Alibaba Group Holding Ltd. and JD.com Inc., particularly after lockdown rules during the pandemic drove people to spend more time online.

In 2021, TikTok started to roll out a similar service for markets including Indonesia, Vietnam and the UK. While it’s pulled back from the British business, it continues to thrive in a Southeast Asian arena that Alibaba’s Lazada, Shopee and Indonesian startup Tokopedia now compete in.

“The rapid growth of TikTok Shop poses a direct threat to Southeast Asia’s incumbent e-commerce leaders,” said Simon Torring, co-founder of e-commerce research firm Cube Asia.

“It is however still too early to declare TikTok Shop’s victory. It has not yet demonstrated the ability to gain significant growth momentum outside the beauty and fashion categories, and a lot of the current growth is heavily subsidized by TikTok through vouchers and aggressive marketing spending.”

TikTok Shop remains a sliver of ByteDance’s $80 billion revenue. By comparison, Sea, Southeast Asia’s largest internet company, grew e-commerce GMV by 18% to $73.5 billion last year.

But its aggressive target, if hit, could help demonstrate live-stream commerce can transcend a niche audience and potentially begin to eat into traditional online shopping beyond Asia.

GMV on Indonesia’s TikTok Shop alone surpassed $2.5 billion last year and topped $1 billion in just the first three months of 2023, according to Cube Asia. At the same time, TikTok slashed about $2 billion off its 2022 target for ad sales, illustrating the slowdown to its core business.

--With assistance from Ville Heiskanen and Peter Elstrom.

(Updates with analyst’s comments from the ninth paragraph)

©2023 Bloomberg L.P.