Feb 3, 2023

This Week in China: The World’s Best Stocks Need New Buyers

, Bloomberg News

(Bloomberg) -- China’s all-or-nothing stock market is losing momentum, after three months of what might be best described as forced buying of a deeply oversold asset.

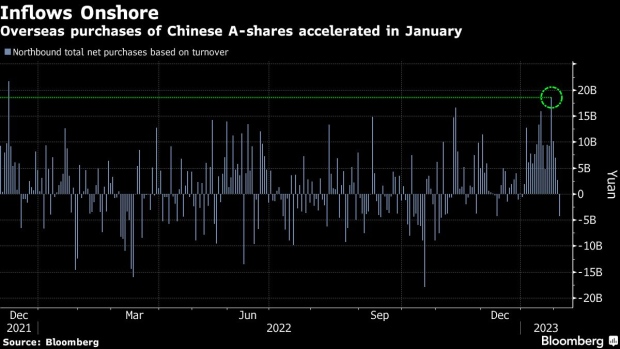

The Hang Seng China Enterprises Index had its worst week since the October panic and mainland markets started the Year of the Rabbit with a whimper. Indicators like the relative-strength index started to fall, shunting the CSI 300 Index back from the cusp of a bull market, despite solid turnover and northbound buying.

What’s notable is investors had plenty of reasons buy. Data showed manufacturing and services expanded and economists rushed to upgrade their 2023 growth outlooks. There was no new Covid variant detected in China, even as millions of people moved across the country for the first time in years. Consumers are spending and President Xi Jinping wants more of it.

The problem? A lack of high-conviction buyers. Hedge funds have mostly covered their short positions and long-only allocators are sticking with strategic underweights strategies for now, even as the Hang Seng China index outperforms every major stock benchmark since its 17-year low in October. You’re unlikely to find animal spirits in the mainland, with retail investors licking their wounds from the property slump.

Here’s my roundup of the week’s key developments for China markets.

Tourism reignited

January marked the first time since the pandemic struck that China’s residents were able to travel freely for the Lunar New Year holiday. They made more than 300 million trips, spent 25% more on restaurants and 83% more in Macau’s casinos than a year ago — well ahead of estimates. Economists boosted GDP forecasts for 2023.

- China Economy Shows Muted Improvement During Holiday Period

- Macau’s Gaming Revenue Jumps 82.5% as China Travel Reignited

Challenges in 2023

Beijing’s to-do list includes reviving the housing market, increasing consumption and selling Chinese goods into a slowing global economy. The outlook for attracting foreign investment is “very complex and severe,” said a commerce ministry official.

- Xi Urges Efforts to Spur Consumption to Propel Economic Rebound

- China’s Home Sales Slump Widened in January Amid Weak Demand

- China Officials Warn of Challenges for Foreign Trade, Investment

Market reforms

Listing onshore may finally be a lot easier for companies. Reducing red tape for initial public offerings is good for entrepreneurs but means more supply in a market that already has about 5,000 stocks. Tutoring and liquor firms won’t be welcome.

- China Proposes IPO Reforms to Overhaul $11 Trillion Stock Market

- China Bans Some Firms From Listing on Main Stock Exchanges: Yicai

Tech wars

A US official said the Biden administration is having conversations around banning US investments in broad parts of China’s tech sector, according to Politico. The US is also considering cutting off Huawei Technologies Co. from all of its American suppliers, including Intel Corp. and Qualcomm Inc.

- Biden Team Weighs Fully Cutting Off Huawei From US Suppliers

- US May Further Curb Investments in China Tech Firms: Politico

Divestments

Warren Buffett has now sold half a billion dollars worth of his stake in Chinese EV giant BYD Co., a stock that’s surging this year. Ontario Teachers’ Pension Plan, a Canadian fund that manages about $180 billion of assets, stopped directly investing in Chinese private assets, partly because of geopolitical risks.

- Huge Canadian Pension Fund Pauses Private China Deals

- Buffett’s Offloading of Stock in BYD Tops $500 Million Mark

Spy balloon

The Biden administration postponed Secretary of State Antony Blinken’s upcoming trip to Beijing after detecting a Chinese surveillance balloon that was hovering over sensitive nuclear sites in Montana. China said the balloon is for climate research and entered US airspace by accident.

- US Postpones Blinken’s Visit to China in Uproar Over Spy Balloon

- What to Know About the Chinese Spy Balloon Floating Over the US

... and three things to watch for next week

- We’ll be in the window for January’s loan and money supply data, which may show whether there’s genuine credit demand in China’s post-Covid-Zero economy.

- China’s largest chipmaker, Semiconductor Manufacturing International Corp., reports earnings. The firm, which is under US sanctions cutting it from critical American technology, is likely to deliver fourth-quarter sales that miss consensus, according to Bloomberg Intelligence.

- Citigroup Inc. researchers see an improved picture for China Inc., predicting a 15% increase in earnings-per-share for companies on the MSCI China Index. They model where profit troughed in previous market cycles, suggesting the gauge could double from last year’s lows.

©2023 Bloomberg L.P.