Jan 10, 2022

The easy money has been made – now it's a stock picker's market

The easy money has been made: Andrew McCreath's 2022 market playbook

Stocks had a banner year in 2021, driven by the impact of fiscal and monetary stimulus on asset prices and a strong recovery in corporate profits.

Looking ahead to 2022, four items merit consideration in assessing the outlook for stocks: inflation, policy stimulus, COVID-19 and geopolitics.

Inflation comes first.

If the current rise in inflation persists, central banks will find themselves well behind the curve -- a situation likely to trigger a material increase in volatility and a tough environment for long-only investors. In addition, the trend in inflation will dictate the pace at which monetary policy accommodation (IE, liquidity) will be withdrawn from the marketplace.

Until U.S. Federal Reserve Chair Jerome Powell caved in December on his previous insistence that inflation was transitory, the Fed had assumed that price pressures would abate concurrent with the normalization of the global supply chain.

However, with every country having unique characteristics to its own COVID experience and the subsequent impact on its manufacturing activities, it appears that the world will continue to suffer a rolling series of supply shortages. We suspect this constant supply-demand tightening will persist until late 2022 or longer.

Food prices are expected to increase markedly during the first quarter of this year for all the same reasons that other prices keep rising: labour, transportation, and supply constraints for the underlying item. And prices for energy products are likely to linger at currently elevated levels long enough to be problematic for the Fed.

Given the hot housing market that cheap money has fuelled on both sides of the border, there’s little question rental prices have more room to rise. Also, even the current level of wage settlements risks transitioning the current supply-driven price pressures to the more insidious demand pull type of inflation.

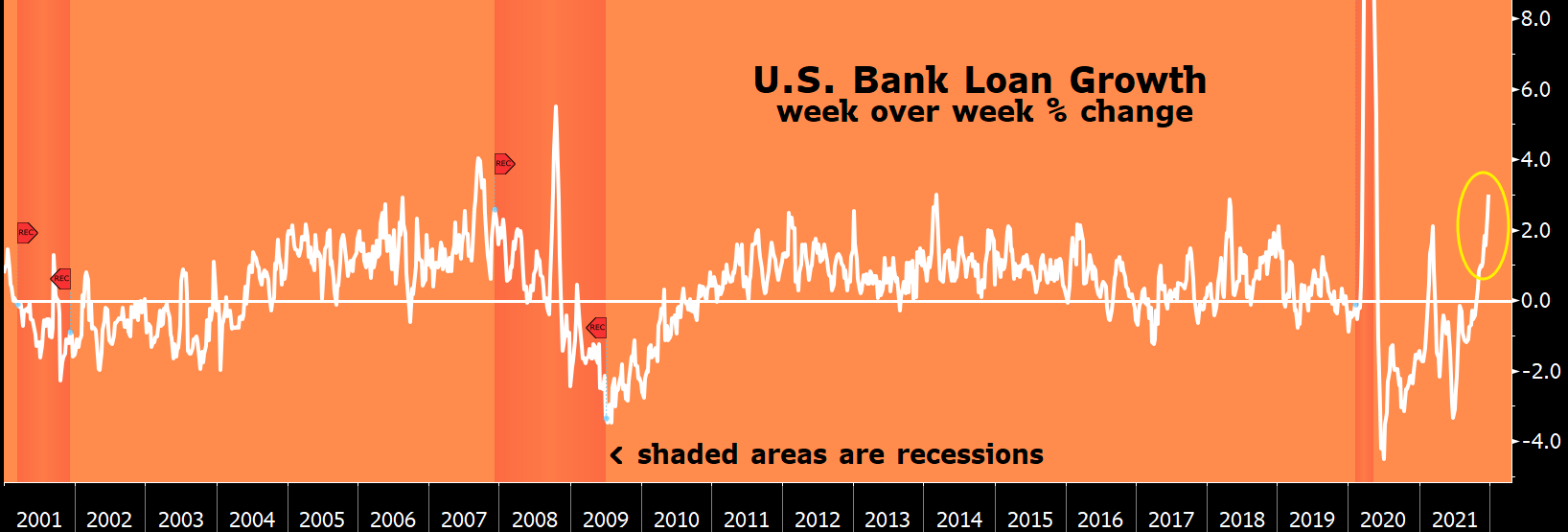

Finally, the yellow oval on the far right side of the 20-year graph above illustrates that U.S. loan growth (red line, right axis) has begun to rise at its fastest pace in years; and, after years of money creation by the Fed, the commercial banks have endless amounts of cash available to lend. A further increase in the rate of loan demand could be highly inflationary and thus problematic for the Fed.

Policy stimulus was the most important driver of financial market performance during 2021. Shifts in monetary policy will dwarf the relevance of changes in fiscal policies.

Next up on the list is the pandemic and let’s all keep our fingers crossed that the optimists are correct in suggesting with Omicron, COVID will migrate to becoming a materially less virulent virus.

Our final variable making the list of items is a perennial favourite, but this year it seems more pertinent, and that’s geopolitics.

The list of hot spots seems to be growing: 1) Russia /Ukraine, 2) Iran (39 per cent inflation, debt-to-GDP at 60 per cent and climbing), 3) China versus the U.S. / rest of the world, 4) U.S. mid-term elections, and 5) the impact of the newly-formed left-wing coalition governing Germany. We will leave it up to you to ponder what impact any of these situations could have on financial markets.

Moving on, we assume that (hopefully) post-Omicron, GDP growth will accelerate through mid-year before slowing during the second half of 2022.

Chinese growth will be unspectacular. Europe will once again be unimpressive in its economic performance. And Canada will generally tag alongside the U.S., albeit featuring some provincial rebalancing (Alberta up, Central Canada down) and a slowing housing market during the second half.

The U.S. dollar should remain well bid unless the European Union surprises to the upside, while our Canadian dollar should have another uneventful year.

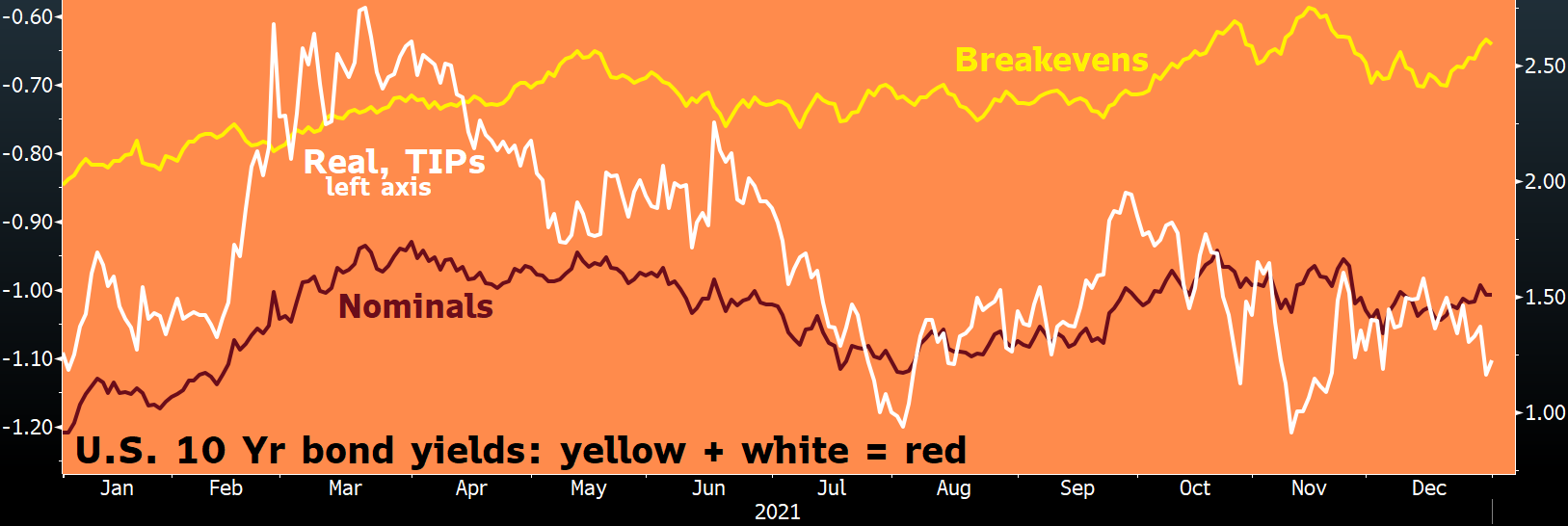

Meanwhile, yields on 10-year U.S. Treasuries should reach the low 2s before year-end.

If inflation reverts toward the Fed’s target of two per cent, breakeven yields (yellow line above, right axis) will decline. In contrast, as the Fed shrinks liquidity, real yields (white line, left axis) or TIPs (Treasury Inflation-Protected Securities) should be expected to rise. Our belief that nominal yields (red line, right axis) trade with a two-handle this year presumes breakevens don’t fall markedly from current levels but real yields move higher.

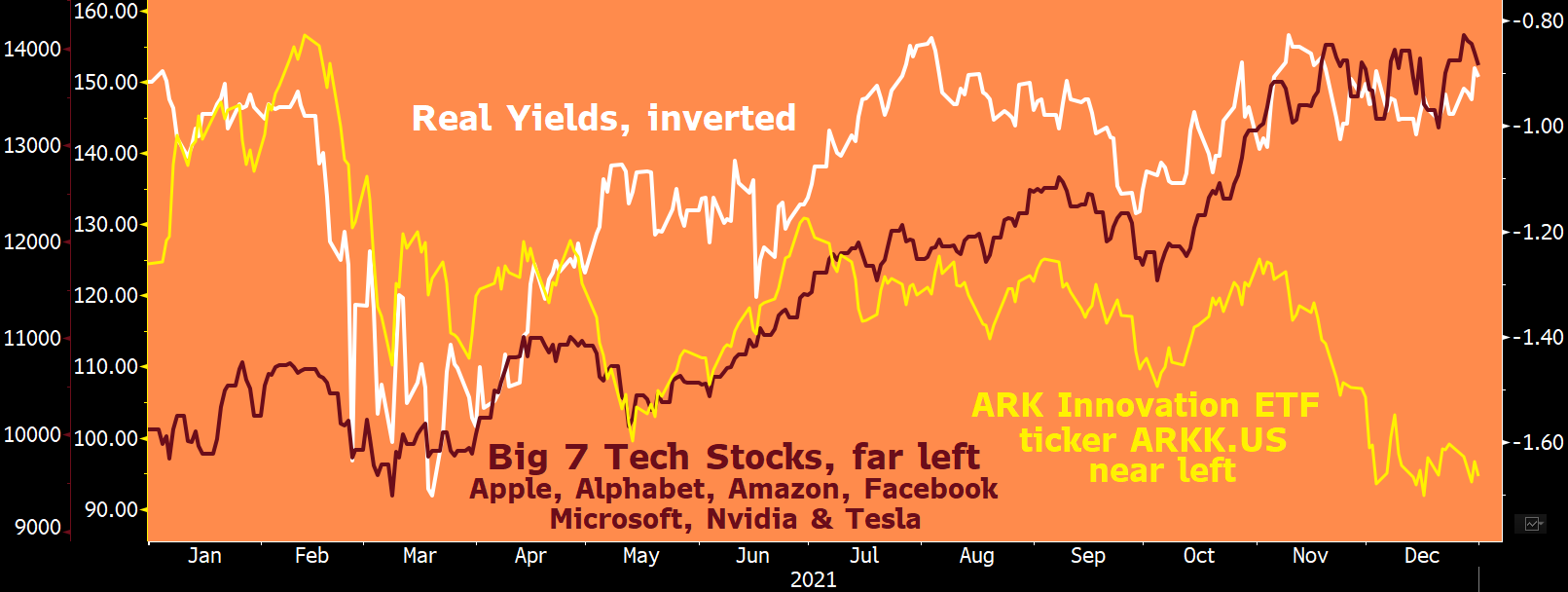

The graph below compares real yields (white line, right axis, inverted) against seven mega-cap tech stocks (red line, far left) and the Ark Innovation ETF (yellow line, near left), a proxy for GAAP (growth at any price) stocks. If real yields rise, large-cap tech stocks are likely to come under pressure and expect an even more pronounced decline in the GAAP stocks.

To summarize, we’ll table three scenarios on inflation:

- Inflation becomes problematic, wage growth picks up, the Fed is seen as being markedly behind the curve, as a result, the pace of rate hikes and withdrawal of liquidity accelerates, and the price of bonds and stocks fall.

- A more matched supply chain stems a further rise in inflation and wage hikes, though price pressures remain stubbornly above the Fed’s target. Receding wage hikes slows consumer spending during late 2022, in turn causing the Fed to push pause on rate hikes, thus causing bonds to rally, factor and style rotation amongst stocks pushes equities higher, and the more growth-oriented U.S. indices outperform Canadian equities.

- Inflation levels show signs of reverting toward the Fed’s target this summer, wages stop climbing, quiescent inflation enables consumer spending to remain strong; bonds rally, equities trade to new all-time highs led by macro-cap tech stocks.

The investment team at Forge First believes markets have just begun to reverse several of the market trends witnessed during the past few years. We expect predictable earnings growth will become of increasing importance as rising real rates trigger a further contraction in price-to-earnings multiples.

We also believe the withdrawal of policy stimulus will create a market that favours stock pickers over market beta. Overall returns are likely to be lower, serving to increase the importance of limiting drawdowns.

Stock-wise, our team expects quality growth, or GARP (growth at a reasonable price), equities and several of the sectors typically associated with value to outperform.

While cautious in the short term, we are becoming increasingly bullish on oil prices. And with valuations having normalized, banks are viewed as solid though unspectacular investments for the next 12 months.

Finally, securities often characterized as bond proxies should struggle to deliver any capital appreciation.

Overall, investors have to accept that returns on financial assets will carry greater risk and offer lower opportunity than the results they may have enjoyed the past few years.

Andrew McCreath is president and chief executive officer of Forge First Asset Management