Jun 9, 2023

Swedes’ View on Housing Market Brightens as Rates May Soon Peak

, Bloomberg News

(Bloomberg) -- Swedes are becoming more upbeat about one of the worst-hit housing markets globally after a year of relentless borrowing-cost increases that have pushed prices lower.

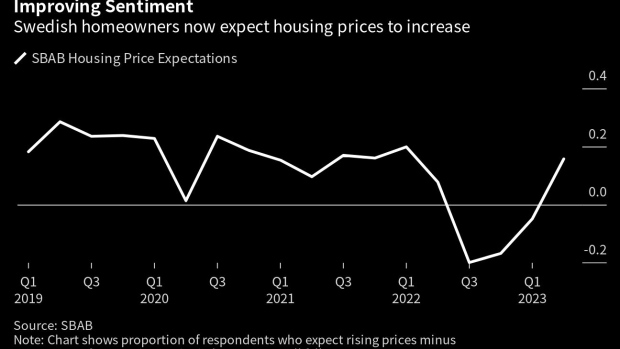

A survey by state-owned lender SBAB indicates that for the first time in a year, more homeowners believe housing prices will rise than decline. At the same time, the country’s largest realtor organization reported a slight price increase in May.

“Prices have stabilized during the spring, and that tendency continued in May,” Joakim Lusensky, head of analysis at the Association of Swedish Real Estate Agents, said in a statement. “Our members report that buyers are becoming more active as they are starting to anticipate that rates are about to peak.”

Swedes’ high proportion of mortgages with rates fixed on short terms, as well as high levels of household indebtedness, made the country’s housing market a test case for what would happen as central banks globally increase borrowing costs to rein in inflation. While the tightening led to rapid declines in 2022, there has been unexpected resiliency this year, leading some forecasters to revise forecasts upwards.

“Since the peak last spring, Swedish housing prices have declined by 13%,” SBAB chief economist Robert Boije said. “Hence, it is no surprise that households have taken a negative view in the past quarters, but there is now a clear increase in optimism.”

Data from the realtor organization show that prices of apartments as well as detached houses increased by 1% in May compared with the average in the prior three-month period. Still, sales volumes are clearly lower than normal, indicating that it remains harder for sellers to find buyers who are willing to pay asking prices, and economists still note that the market may fall further as rate hikes continue to bite into borrowers’ finances.

“We stick to our forecast that housing prices will continue declining somewhat in the short term,” Boije said. “Our assessment is that we still haven’t seen the full effect of rate hikes on housing prices.”

©2023 Bloomberg L.P.